Troubleshooting Insurance Estimates

This document provides troubleshooting steps to help ensure accurate insurance estimates. The commercial insurance plans that Dentrix Ascend supports are PPO (Preferred Provider Organization), DHMO (Dental Health Maintenance Organization), and indemnity.

Ledger

Procedure details

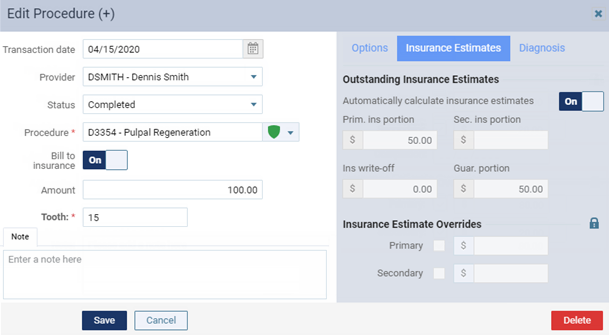

Click (or tap) a procedure on the patient's Ledger page, and then check the following details:

Bill to insurance

-

If this procedure should be billed to insurance, make sure that the Bill to insurance switch is set to On.

-

If this procedure should not be billed to insurance, make sure that the Bill to insurance switch is set to Off.

Insurance Estimate Overrides

Verify if the Automatically calculate insurance estimates switch is set to On. If it is set to Off, and there are incorrect estimates, change the Prim. ins portion, Sec. ins portion, and/or Ins write-off amounts.

Important: Turning off automatic insurance estimates has the following repercussions:

-

The benefit maximums and required deductibles are not used to calculate estimates for this procedure.

-

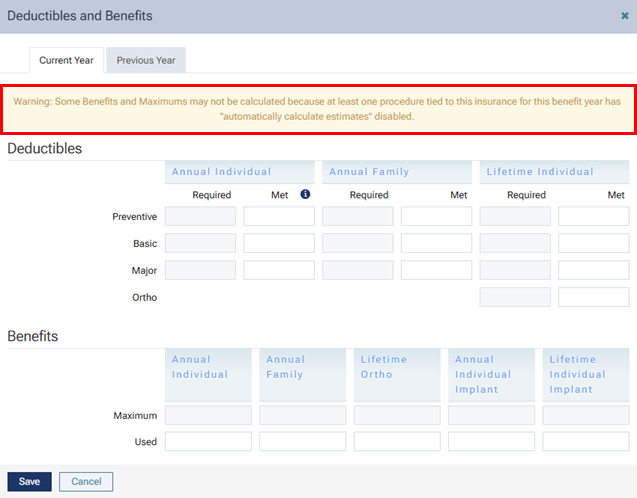

With this switch off for the procedure, if you view the Deductibles and Benefits dialog box for the patient’s insurance plan (Patient > Insurance Information, select the plan, and then click Benefits), there is a warning message. The message states that one or more procedures have the Automatically calculate insurance estimates switch set to Off, so some benefit maximums and required deductibles may not be used to calculate estimates.

-

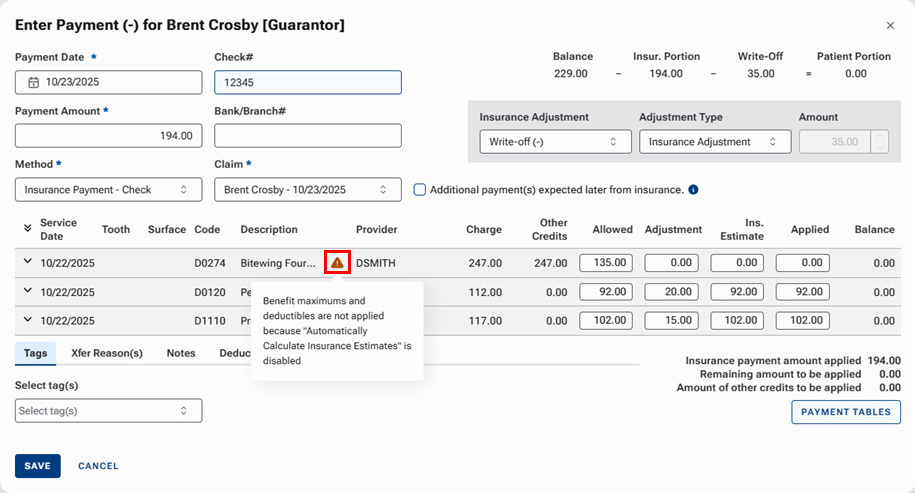

Also, when you are entering an insurance payment for a claim with this procedure, there is a warning icon and message that appears next to the procedure's description. The message states that the Automatically calculate insurance estimates switch set to Off, so the used benefit maximums and met deductibles are not updated.

-

-

When changes that affect insurance estimates cause the Ins. est. update available flag to appear on the patient's Ledger, Patient Portion, or Guarantor Portion page, updating the estimates for unpaid procedures does not update the estimates for this procedure, so the estimates for it may need to be updated manually.

-

While using the Detailed View of the Patient Portion or Guarantor Portion page, a crossed-out calculator symbol appears next to the procedure to indicate that insurance estimates are not being calculated automatically, and the allowable amounts and coverage percentages do not appear.

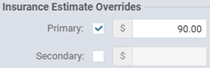

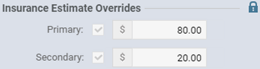

Insurance Estimate Overrides

-

If this procedure is missing any Insurance Estimate Overrides, select the Primary and/or Secondary checkboxes, and then enter the Primary and/or Secondary amounts.

-

If this procedure has any incorrect Insurance Estimate Overrides, clear the Primary and/or Secondary checkboxes to remove the overrides, or edit the Primary and/or Secondary amounts.

-

If the Insurance Estimate Overrides are locked, if your user account has the rights to do so, click the Unlock icon to enter your credentials and then remove the overrides or edit the amounts if they are incorrect.

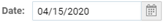

Date

Make sure that the procedure Date is the correct date of service.

Note: For the procedure to be eligible for insurance coverage, the date must be within the coverage period of the patient's insurance plan.

Amount

-

Make sure that the Amount is correct.

-

If the Amount has been overridden, click the Update to link to update the charge if it is incorrect.

Note: By default, the procedure Amount comes from the selected procedure on the selected provider's preferred fee schedule; however, if the selected procedure does not exist on that fee schedule, or the selected provider does not have a preferred fee schedule, the amount comes from the selected procedure on the location's procedure code list.

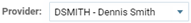

Provider

Make sure that the Provider is the correct rendering provider. The selected provider's preferred fee schedule is used to populate the Amount box by default. If the provider does not have a preferred fee schedule, the location's procedure code list is used.

Important: The rendering provider may be different from the billing provider, and it is the billing provider who must be contracted with the insurance carrier that administer the patient's insurance plan (PPO or DHMO plan only) for the insurance estimates to be calculated correctly.

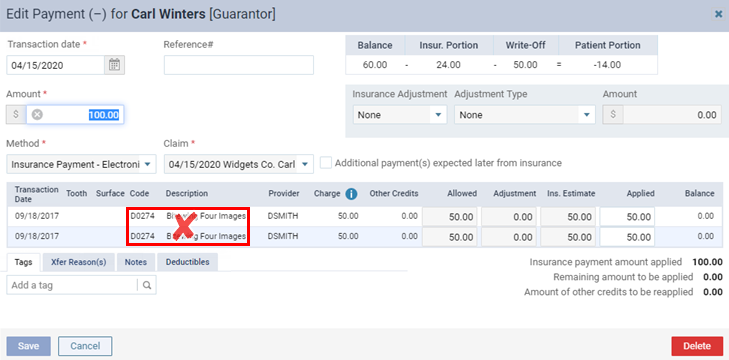

Applied payments and credits

-

On the patient's Ledger page, check if any payments (patient or insurance) and credit adjustments are applied to the procedure.

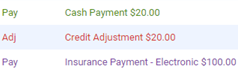

Applied patient payments

Click (or tap) a patient payment. In the Edit Payment dialog box, see if the procedure is listed and has an Applied amount. If so, this affects the patient portion.

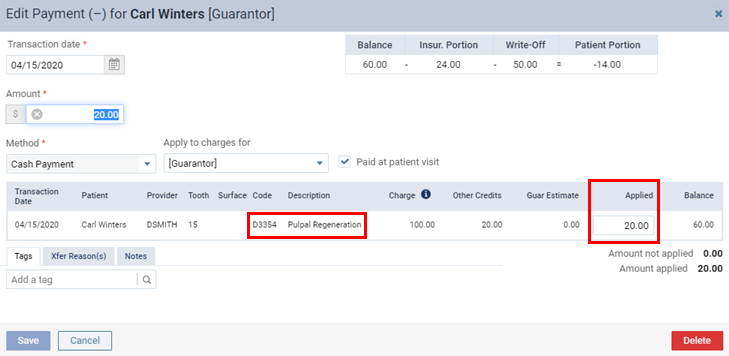

Applied credit adjustments

Click (or tap) a credit adjustment. In the Edit Credit Adjustment dialog box, see if the procedure is listed and has an Applied amount. If so, this affects the patient portion.

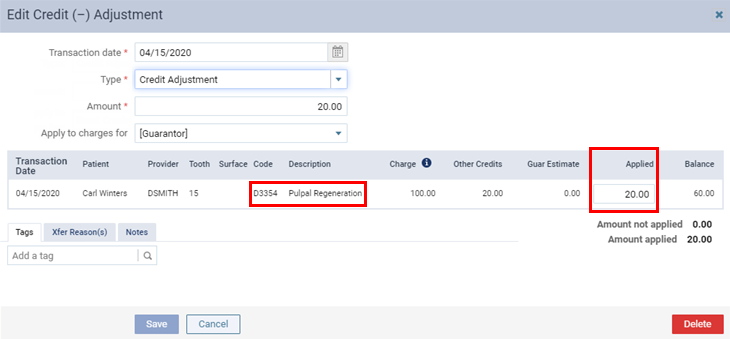

Applied insurance payments

Click (or tap) an insurance payment. In the Edit Payment dialog box, see if the procedure is listed and has an Applied amount. If so, this affects the insurance and patient portions.

-

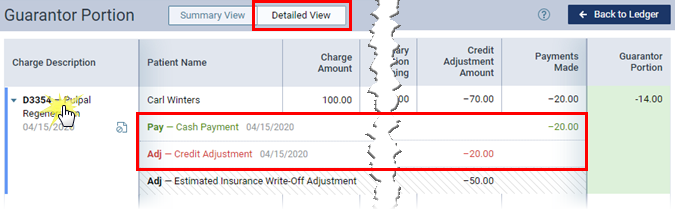

On the patient's Ledger page, click (or tap) the amount in the Patient Portion box. On the Detailed View tab of the Patient Portion or Guarantor Portion page, click (or tap) a Charge Description to check if any payments (patient or insurance) and credit adjustments are applied to the procedure.

Patient's coverage

Insurance plan

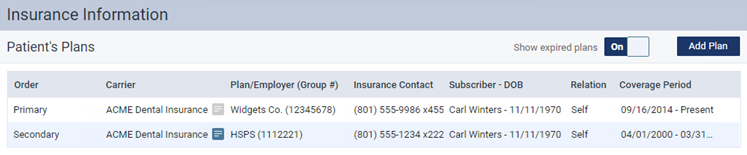

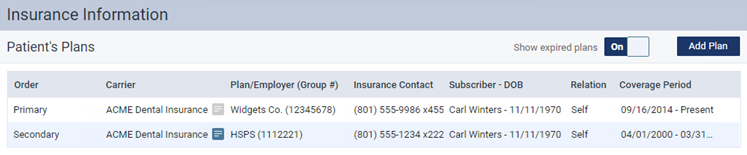

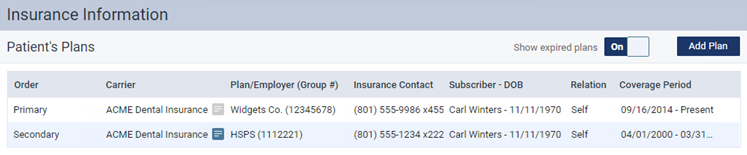

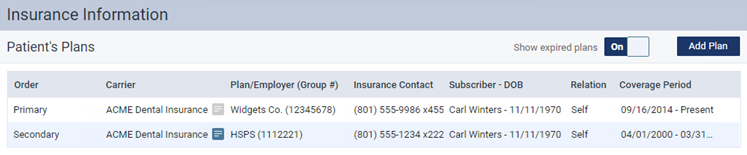

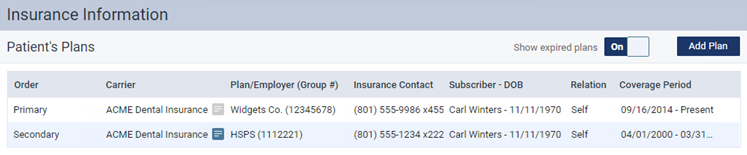

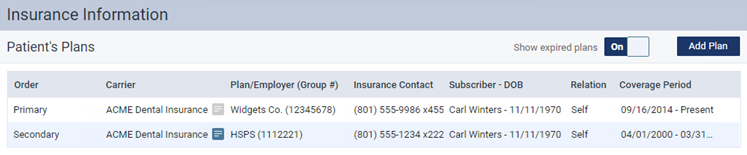

Check the patient's insurance plan:

-

On the patient ribbon, if the patient has an active insurance plan, the Insurance icon is green; if not, it is gray. Click (or tap) the icon to view the patient's Insurance Information page.

-

If the desired plan is not listed, it may be expired. Set the Show Expired Plans switch to On to view all the patient's insurance plans.

-

If the desired plan is listed, make sure that the Insurance coordination order and Coverage Period are correct.

-

Do any of the following as needed:

Attach an insurance plan

-

On the patient's Insurance Information page, click (or tap) Add Plan.

The options for entering insurance information become available.

-

Specify the Subscriber.

Do one of the following:

-

If the patient is the subscriber for the plan that you are going to enter, leave his or her name in the Subscriber box.

-

If the patient is not the subscriber for the plan that you are going to enter, clear the name from the Subscriber box, begin typing part of the subscriber's name, continue typing as needed to narrow the results list, and then select a subscriber's name. The names of the insurance carrier and plan (or employer) that are attached to the selected subscriber appear automatically. (Skip step 3.)

-

-

If the patient is the subscriber, use the Plan Search box to search for and select an insurance plan.

Do one of the following:

-

Select a plan by carrier, plan name, or group number:

-

Select Search by Carrier/Plan/Employer.

-

In the Plan Search box, begin typing a carrier name, an employer or a group plan name, or a group number. Continue typing as needed to narrow the results list. Then, select a plan.

-

-

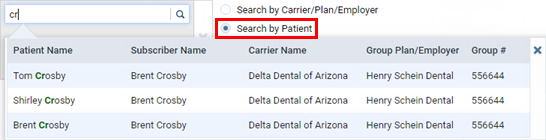

Select a plan by patient:

-

Select Search by Patient.

-

In the Plan Search box, begin typing a patient name. Continue typing as needed to narrow the results list. Then, select the patient with the correct plan.

-

-

Add a new plan:

-

If there are no results for the search criteria that you enter in the Plan Search box, click (or tap) Add New Carrier or Plan.

The Add New Carrier or Plan dialog box appears.

-

Do one of the following:

-

Select an insurance carrier from the list of carriers that have already been added to your practice database.

-

Add an insurance carrier to your organization's database:

-

Click (or tap) Add Carrier.

Note: Adding insurance carriers requires the "Create Carriers" security right.

The Select carrier box becomes available.

-

In the Select carrier box, begin typing the insurance carrier's name or payer ID. A list of supported insurance carriers appears. Continue typing as needed to narrow the search results.

Important: Henry Schein One maintains a database of supported payers. The database is updated regularly, and a list of carriers and each carrier's details is sent to Dentrix Ascend. Selecting a carrier from the list of supported payers ensures that your practice has up-to-date information for that carrier. Also, using a supported payer allows you to add attachments to claims (however, the payer might not accept electronic attachments; in which case, you can mail the attachments separately from the claims or print and mail the claim and attachments together).

-

Do one of the following:

-

If the correct insurance carrier is listed, click (or tap) it to populate the boxes with that carrier's information.

-

If the correct insurance carrier name is not listed, finish typing the full name. The name must start with a number or letter, not a special character).

Then, press the Tab key, or click (or tap) outside the box. A message about adding unsupported payers appears.

Click (or tap) Use New Carrier Name. The options for adding a new insurance carrier become available.

-

-

Set up the other options as needed:

-

Expected period of insurance claim resolution - The number of days after which you want to consider claims that are sent to the insurance carrier as being overdue. By default, the turnaround time is set to 14 days, but you can specify a different number of days to reflect the time frame that the carrier usually requires to process claims.

-

Phone number - The insurance carrier's main contact phone number and extension (if applicable).

-

Fax number - A fax number for the insurance carrier.

-

Website - The insurance carrier's website address. Do not include "http://" or "https://" at the beginning of the website address.

Notes:

-

You cannot change the Carrier Name name after you click (or tap) Add.

-

You cannot change the insurance carrier's Payer ID. The ID comes from a database (maintained by Henry Schein One) of payers that accept electronic claims, or if the payer is not supported, the ID is 06126 (in which case, the clearinghouse will have to print and mail a hard copy of the claim to the payer).

-

You must save the insurance carrier's information to make the Available Procedures button available, so you can specify which procedures are available for posting to the records of patients who are covered by this carrier (when the "Carrier procedures" procedure filter is selected during posting).

-

-

Click (or tap) Add.

-

The options for adding a plan become available.

Note: Adding plans to insurance carriers requires the "Create Insurance Plans" security right.

-

-

Set up the following options:

-

Plan/Employer Name - The name of the employer or insurance plan.

-

Group # - The group plan number.

-

Claim mailing address - The address where claims for the insurance plan are sent.

Notes:

-

When you click in the first box, start typing a street address, city, state abbreviation, or ZIP Code. A list of matching addresses appears. Continue typing as needed to narrow down the results.

The list of matching addresses comes from the claim mailing addresses that have been entered across all the existing insurance plans in your organization's database.

-

Selecting an address updates the street address, city, state abbreviation, and ZIP Code for this plan accordingly.

-

If the correct address is not found, finish typing the street, and then specify the remaining parts of the address manually.

-

If you select an address, you can edit any part of the address as needed for this plan. Any changes that you make do not affect the addresses of any other plans.

-

-

ZIP Codes must be nine digits.

-

-

Phone - The insurance plan administrator's contact phone number and extension (if applicable).

-

Fax Number - The fax number of the insurance plan administrator.

-

Contact - The name of the insurance plan administrator.

-

Email - The insurance plan administrator's email address.

-

Benefit Renewal Month - The month that the insurance plan's benefits reset.

-

Source of Payment - The type of insurance company that will remit payment: CHAMPUS, Blue Cross/Blue Shield, Commercial Insurance, Commercial Insurance (PPO), Commercial Insurance (DHMO), Medicare Part B, or Medicaid.

-

Type - The plan covers dental or medical procedures.

-

Missing tooth clause? - Indicates if a missing tooth clause applies to the plan. Select one of the following options: Not Specified, Yes, or No.

Note: Currently, this option is for reference only.

-

Eligibility coverage level - Indicates the type of coverage that applies to the plan. Select one of the following options: Not Specified, Individual, Family, Employee Only, Employee and Spouse, Employee and Children, Spouse Only, Spouse and Children, Children Only, or Dependents Only.

Note: Currently, this option is for reference only.

-

Crowns/Bridges paid on - Indicates if the plan guidelines base payment on the preparation or seat date for procedures such as crowns and bridges. Select one of the following options: Not Specified, Prep Date, or Seat Date.

Note: Currently, this option is for reference only.

-

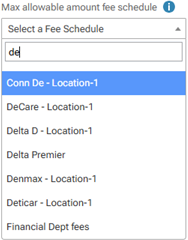

Max allowable amount fee schedule - The schedule of allowed charges for the insurance plan (PPO or DHMO plan only). The selected fee schedule will be used to determine a patient's portion and the recommended write-off.

Important: For each provider (and each location that is set up as a billing provider for claims) who participates with this insurance plan, in that provider's user account (or that location's settings), you must select this carrier in the Contracted With section.

You can also click (or tap) Max Allowable All Locations to open the Max Allowable Amount Fee Schedules By Location dialog box and set the max allowable fee schedule for the insurance plan by location. Access to this dialog box is available only if the Plan/Employer Name, Claim mailing address, City, State, ZIP Code, and Benefit renewal month have been entered.

-

Coverage Table - The coverage table for the plan. Click (or tap) Coverage Table to open the Coverage Table for dialog box. Access to this dialog box is available only if the Plan/Employer Name, Claim mailing address, City, State, ZIP Code, and Benefit renewal month have been entered.

For a coverage table that is based on insurance coverage percentages, change the default deductible type and/or coverage percentage for each procedure code range. For a coverage table that is based on fixed, patient copayments, change the default deductible type and/or copayment amount.

Note: You can also add exceptions, which are used by Dentrix Ascend to automatically calculate insurance estimates.

-

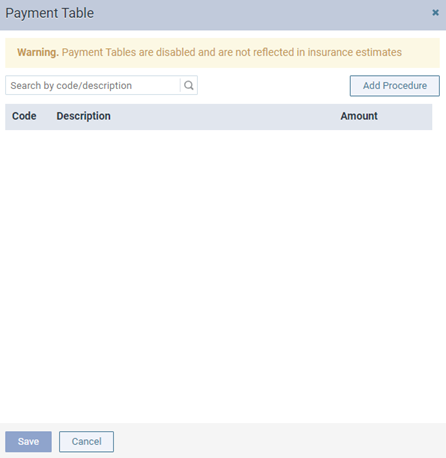

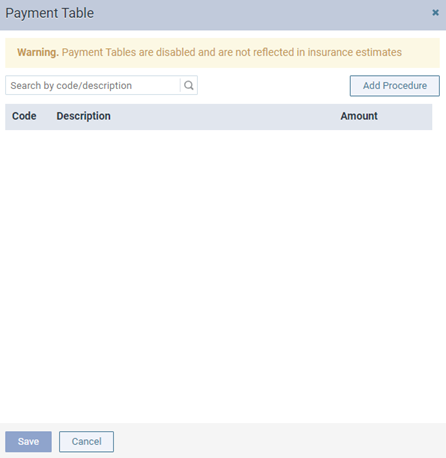

Payment Table - The payment table for the plan. Click (or tap) Payment Table to open the Payment Table dialog box. Access to this dialog box is available only if the Plan/Employer Name, Claim mailing address, City, State, ZIP Code, and Benefit renewal month have been entered.

Manually add procedures in the plan's payment table as needed.

-

Predeterminations - The procedures that require a predetermination (pre-authorization) under this plan. Click (or tap) Predeterminations to open the Manage Predeterminations dialog box. Access to this dialog box is available only if the Plan/Employer Name, Claim mailing address, City, State, ZIP Code, and Benefit renewal month have been entered.

Do any of the following:

-

Select checkboxes:

-

To select the checkboxes of the listed procedures that commonly require a predetermination, click (or tap) Load Defaults. Be aware that doing this replaces the current selections.

-

To select the checkboxes of the listed procedures according to the selections from another insurance plan, enter your search criteria (part of a carrier name, plan/employer name, or group number) in the Replace with box, continue typing as needed to narrow the results, and then select the correct plan. Be aware that doing this replaces the current selections.

-

Manually select or clear the checkboxes of procedures in the list as needed.

Note: To quickly locate a procedure, begin entering part of its code, description, or treatment area in the Search for procedure box. The procedures that match your search criteria are listed. Continue typing as needed to narrow the results.

-

-

Set a charge threshold - To require a predetermination for any procedure that is not selected in the list but whose charge equals or exceeds a certain amount, select the Require predetermination for procedures over checkbox, and then enter an amount in the box provided.

-

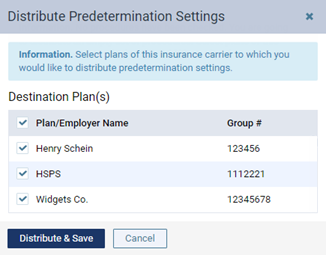

Copy selections to other plans - To copy this plan's selections to other plans that are associated with this plan's carrier, click (or tap) Distribute Settings. In the Distribute Predetermination Settings dialog box, select the checkboxes of the correct plans, and then click (or tap) Distribute & Save. Be aware that doing this replaces the current selections for the destination plans.

-

-

Note - A note that is specific to this insurance plan. You can enter text, such as information from an EOB or other document from the insurance carrier. Also, you can insert a date if needed. The note is accessible from all patient records that have this insurance plan attached.

-

-

Click (or tap) Save.

-

To enter the required deductibles and maximum benefits for the plan, click (or tap) Benefits to open the Deductible and Benefits dialog box. Access to this dialog box is available only after you save the plan.

Enter the required deductible amounts for each deductible type, enter the maximum benefits allowed, and then click (or tap) Save.

Note: Adding required deductibles and maximum benefits to insurance plans requires the "Edit Benefits" security right.

-

To specify the methods for handling the Coordination of Benefits (COB) between primary and secondary insurance claims for a patient with this insurance plan as his or her secondary plan, click (or tap) Coordination of Benefits to open the Coordination of Benefits for dialog box. Access to this dialog box is available only after you save the plan.

For each Source of Payment for Primary Insurance Plan, select a Method for Coordination of Benefits, and then click (or tap) Save.

Notes:

-

If this insurance plan is attached to a patient's record as a secondary plan, the method being used for coordinating benefits appears on the patient's Insurance Information page when the options for the secondary plan are being displayed.

-

Changing the coordination of benefits for insurance plans requires the "Edit Insurance Plans" security right.

-

-

Click (or tap) Save.

-

-

-

Set up the rest of the options as needed, such as the subscriber ID, relation to the subscriber, coverage order, and coverage period.

Set up the following options:

-

Subscriber ID # - The ID used to identify the subscriber of the insurance plan on claims that are submitted to the corresponding carrier. The subscriber ID might not be the same as the subscriber's Social Security Number.

Notes:

-

When you save the plan, Dentrix Ascend attempts to verify with the carrier that the subscriber ID is valid. You may see a notification that the carrier does not accept real-time eligibility verification, the subscriber ID is invalid, or the subscriber ID could not be verified. These issues affect the patient's eligibility status for his or her appointments on the Insurance Eligibility page.

-

You can also submit an on-demand request to validate the subscriber ID.

-

-

Release of Information - The subscriber authorizes the release of information to the practice. With this check box selected, "Signature on File" appears in box 36 on insurance claims. With this check box clear, box 36 is blank.

Notes:

-

For a subscriber, the default state of the Release of Information check box is determined by a certain insurance default.

-

Selecting or clearing the Release of Information check box requires the "Edit Ins. Plan for Patient" and "Manage Subscriber Authorizations" security rights.

-

-

Assignment of Benefits - The subscriber authorizes payments from the carrier to go directly to the provider. With this check box selected, "Signature on File" appears in box 37 on insurance claims, and the carrier will send payments to your practice. With this check box clear, box 37 is blank, and the carrier will send payments to the subscriber.

Notes:

-

For a subscriber, the default state of the Assignment of Benefits check box is determined by a certain insurance default.

-

Selecting or clearing the Assignment of Benefits check box requires the "Edit Ins. Plan for Patient" and "Manage Subscriber Authorizations" security rights.

-

-

Relation to Subscriber - For a subscriber, since he or she is the current patient, Self is selected automatically and cannot be changed. For a non-subscriber, select Spouse, Child, or Other.

-

Insurance coordination order - The coverage order of the plan (such as Primary or Secondary).

Note: The positions that are available on the list are the positions in the coverage order that have active insurance plans, the positions in the coverage order that are missing insurance plans, and an additional position at the end of the coverage order.

-

Coverage Period - The date range that coverage under the plan is valid for the subscriber and his or her dependents. In the Coverage Start and Coverage End boxes, enter the date when coverage started and, if known, when it will end. For a non-subscriber, you can specify an end date that is before or the same as that of the subscriber.

Note: For a secondary insurance plan, the start date cannot be earlier than the start date of the patient's primary insurance plan.

-

Eligibility - The patient's eligibility for coverage under the plan has been checked. If known, select the patient's eligibility status from the list: Unable to Verify, Eligible, or Ineligible. Then, enter today's date (or the date that eligibility was actually checked) in the Verification Date box.

Note: Changing the eligibility status here affects the patient's eligibility status for his or her appointments on the Insurance Eligibility page and vice versa.

-

Note - Any notes regarding the insurance plan.

-

-

Click (or tap) Save.

-

To update the met deductibles and used benefits, click (or tap) Benefits. Access to the deductibles and benefits is available only after you save the plan in the patient's record.

Note: Updating the met deductibles and used benefits requires the "Edit Ins. Benefits for Patient" security right.

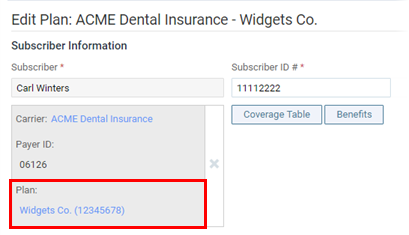

Update an insurance plan

-

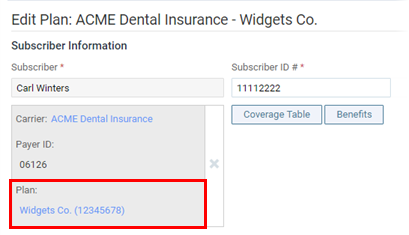

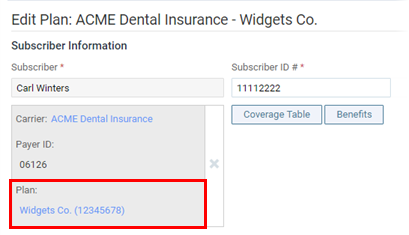

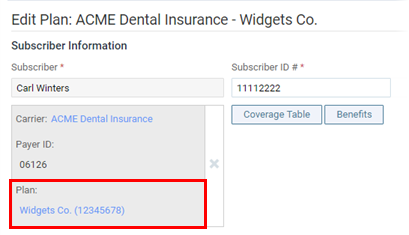

On the patient's Insurance Information page, select an insurance plan.

The options for editing insurance information become available.

-

Update the information as needed, such as the subscriber ID, relation to the subscriber, coverage order, and coverage period.

Set up the following options:

-

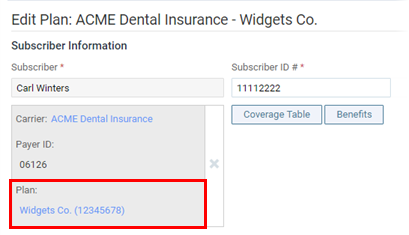

Subscriber and Plan - The subscriber and insurance associated with that subscriber. To change the subscriber and plan, click (or tap) in the Subscriber box, search for and select a different provider, and then select a plan. To change only the plan, select a different plan for the selected subscriber. To show or hide the plan selection list, click (or tap) the Show button

or the Hide button

or the Hide button  .

. -

Subscriber ID # - The ID used to identify the subscriber of the insurance plan on claims that are submitted to the corresponding carrier. The subscriber ID might not be the same as the subscriber's Social Security Number. Changing the ID will affect the subscriber and all patients covered under that subscriber.

Notes:

-

When you save the plan, Dentrix Ascend attempts to verify with the carrier that the subscriber ID is valid. You may see a notification that the carrier does not accept real-time eligibility verification, the subscriber ID is invalid, or the subscriber ID could not be verified. These issues affect the patient's eligibility status for his or her appointments on the Insurance Eligibility page.

-

You can also submit an on-demand request to validate the subscriber ID.

-

-

Release of Information - The subscriber authorizes the release of information to the practice. With this check box selected, "Signature on File" appears in box 36 on insurance claims. With this check box clear, box 36 is blank.

Note: Selecting or clearing the Release of Information check box requires the "Manage Subscriber Authorizations" security right.

-

Assignment of Benefits - The subscriber authorizes payments from the carrier to go directly to the provider. With this check box selected, "Signature on File" appears in box 37 on insurance claims, and the carrier will send payments to your practice. With this check box clear, box 37 is blank, and the carrier will send payments to the subscriber.

Note: Selecting or clearing the Assignment of Benefits check box requires the "Manage Subscriber Authorizations" security right.

-

Relation to Subscriber - For a subscriber, since he or she is the current patient, Self is selected automatically and cannot be changed. For a non-subscriber, select Spouse, Child, or Other.

-

Insurance coordination order - The coverage order of the plan (such as Primary or Secondary).

Note: The positions that are available on the list are the positions in the coverage order that have active insurance plans and the positions in the coverage order that are missing insurance plans.

-

Coverage Period - In the Coverage Start and Coverage End boxes, enter the date that coverage started and, if known, the date that the coverage will end for the subscriber and all patients who are insured under the selected plan. For a non-subscriber, you can specify an end date that is before or the same as that of the subscriber.

Notes:

-

For a secondary insurance plan, the start date cannot be earlier than the start date of the patient's primary insurance plan.

-

You cannot save a change in the coverage period if doing so would cause an outstanding claim not to be inside that coverage period. You must resolve the claim before you can change the coverage period.

-

-

Eligibility - If known, select the patient's eligibility status: Unable to Verify, Eligible, or Ineligible. Then, enter today's date (or the date that eligibility was actually checked) in the Verification Date box.

Note: Changing the eligibility status here affects the patient's eligibility status for his or her appointments on the Insurance Eligibility page and vice versa.

-

Note - Any notes regarding the insurance plan.

-

-

Click (or tap) Save.

-

Note: For the procedure to be eligible for insurance coverage, the procedure date must be within the coverage period of a plan.

Payment table

Verify if the setting that allows payment tables to override coverage tables for insurance estimates is enabled or disabled. If it is enabled, verify that the payment table for the patient's insurance plan is set up correctly.

Enabling or disabling payment tables for insurance estimates

-

On the Settings menu, select Ledger Options.

The Ledger Options page opens.

-

Select the Ledger Rules tab.

-

Under Insurance Estimates & Write-Offs, set the Enable Payment Tables switch to one of the following statuses:

-

Yes - Payment tables can be used for calculating insurance estimates in your organization.

Notes:

-

If there is an override at the procedure level, that amount is used as the insurance portion instead of the amount in the payment table.

-

If the procedure exists in the payment table, that amount is used as the insurance portion.

-

The write-off for the remaining amount is based on the coverage table.

-

Whether or not payment tables are used, the insurance portion cannot exceed the procedure amount, the patient portion is equal to the procedure amount minus the sum of the insurance portion and the write-off amount, and estimates take used benefits and deductibles into account.

-

When you are viewing estimate details, if a payment table is in use for a procedure, that procedure’s amount is orange, and if you click the amount, a Payment Table In Use pop-up message appears for your reference.

-

-

No - Payment tables do not affect insurance estimates.

Note: A message appears in the payment tables of insurance plans to indicate that payment tables do not affect insurance estimates.

-

-

Click (or tap) Save.

Viewing and editing the payment table

-

On the patient's Insurance Information page, select an insurance plan.

The options for editing insurance information become available.

-

Click (or tap) the Plan link.

The Insurance Carriers page opens and displays the options for editing the insurance plan.

-

Click (or tap) Payment Table.

The Payment Table dialog box appears.

Notes:

-

Initially, the plan's payment table is empty.

-

Over time, as you update the payment table, the list may become long. To filter to list to show only procedures that match search criteria that you enter, in the Search by code/description box located above the list, begin typing a code or description.

-

-

Do any of the following as needed:

-

To add procedures, do the following:

-

Click Add Procedure to add a line item at the top of the list.

-

In the Search box, begin typing part of a procedure code or description, and then select the correct procedure.

The Amount box is selected automatically.

-

Enter the amount that the payer pays for the selected procedure.

-

Repeat steps a-c as needed to add other procedures.

Note: As you add procedures, they are inserted before any existing procedures in the list. However, when you save the changes and then reopen the dialog box, the procedures are sorted by code.

-

-

To remove a procedure, click the corresponding X.

-

To edit a procedure's amount, click (or tap) in the corresponding Amount box, and then enter a new value.

-

Coverage table

Verify that the coverage table for the patient's insurance plan is set up correctly, and see if there are any exceptions for the procedure in that coverage table.

Viewing and editing the coverage table

-

On the patient's Insurance Information page, select an insurance plan.

The options for editing insurance information become available.

-

Click (or tap) the Plan link.

The Insurance Carriers page opens and displays the options for editing the insurance plan.

-

Click (or tap) Coverage Table.

The Coverage Table dialog box appears.

Insurance Coverage, %

Patient Copayment, $

-

Make sure the following are correct:

-

Type: "Insurance Coverage, %" or "Patient Copayment, $"

-

Code Range (for Insurance Coverage, %) or Procedure Code (for Patient Copayment, $)

-

Deductible Type

-

Coverage % (for Insurance Coverage, %) or Copayment $ (for Patient Copayment, $)

-

-

If necessary, you can change the type of coverage table. From the Type list, select either Insurance Coverage, % or Patient Copayment, $ to specify whether the coverage should be based on a percentage or a fixed amount, respectively.

Notes:

-

If you change the type from Insurance Coverage, % to Patient Copayment, $, the coverage table changes to either the previous version of the patient copayment ($) type coverage table for this plan or, if this is the first time that you have changed the type, the default patient copayment ($) type coverage table.

-

If you change the type from Patient Copayment, $ to Insurance Coverage, %, the coverage table changes to either the previous version of the insurance coverage (%) type coverage table for this plan or, if this is the first time that you have changed the type, the default insurance coverage (%) type coverage table.

-

-

If necessary, you can replace the coverage table with that of a template or another plan, or you can delete the coverage table to make a new one from scratch (not recommended).

-

Do one of the following:

-

For an Insurance Coverage, % table, add, edit, and delete the procedure code ranges as needed.

Do the following:

-

Click (or tap) Add Range to add a procedure code range, or select an existing range to edit that range.

-

Set up the following options for that range as needed:

-

Code Range - The ADA or custom procedure code range. These boxes accept dashes (-), periods (.), numbers, and letters, and they can be up to 10 characters in length. Make sure there are not any overlaps and gaps in the sequence between the starting and ending codes in the range and between other ranges.

You can include an alias procedure codes in a range by typing a period (.) in either box. The Code Range boxes change to allow for entering suffixes. Enter a suffix in either or both suffix boxes. If you need a period in either of the main code boxes (the boxes to the left of the suffix boxes), you must type the period again in that box.

Note: When you change a range and then click (or tap) somewhere else, the text of the range that you modified turns bold. Also, any ranges that overlap or that are invalid become highlighted in red, and you cannot save the changes to the coverage table until those errors are resolved.

-

Category - The procedure category for the procedures in the range.

-

Deductible Type - The type of deductible that the procedures in the range apply to.

-

Coverage % - The percent that the insurance carrier pays on covered charges (after any deductible, up to any allowed amount, and up to any maximum allowed benefit) for procedures in the range.

-

-

Repeat the steps a - b for any other ranges that you want to add or edit.

-

To delete a range, click (or tap) the corresponding Remove button

, and then click (or tap) Delete on the confirmation message that appears.

, and then click (or tap) Delete on the confirmation message that appears.Important: If you are deleting the only range in the coverage table, the entire table will be deleted.

-

-

For a Patient Copayment, $ table, add, edit, and delete the procedure codes as needed.

Do the following:

-

To add procedures codes, do the following:

-

Click (or tap) Add Procedure.

The Add Procedures dialog box appears.

-

Select the check boxes of the procedure codes that you want to add to the coverage table. You can select or deselect the check box in the column header to select and deselect all the procedure codes at the same time.

-

Click (or tap) Add Checked.

Note: If you are adding procedure codes to a coverage table that already has procedure codes, the procedure codes are added at the top of the table, which might not be the correct order; however, when you save the template, the procedure codes will be listed in the correct order.

-

-

To edit an existing or newly-added procedure code, select it.

-

Set up the following options for that code as needed:

-

Deductible Type - The type of deductible that the procedure applies to.

-

Copayment $ - The patient co-pay. Patients will pay the specified amount for the procedure.

-

-

Repeat the steps a - c for any other codes that you want to add or edit.

-

To delete a code, click (or tap) the corresponding Remove button

, and then click (or tap) Delete on the confirmation message that appears.

, and then click (or tap) Delete on the confirmation message that appears.Important: If you are deleting the only code in the coverage table, the entire table will be deleted.

-

-

-

To add, edit, or delete exceptions to the coverage for specific procedures, click (or tap) Manage Exceptions.

-

Do one of the following:

-

To apply the changes to the coverage table and create a new coverage table template using the specified coverage options, click (or tap) Save As New Template. In the New Coverage Table Template dialog box that appears, enter a name for the template, and then click (or tap) Save.

-

To apply the changes to the coverage table, click (or tap) Save.

-

-

Click (or tap) Save or Cancel.

Viewing and editing exceptions in the coverage table

-

On the patient's Insurance Information page, select an insurance plan.

The options for editing insurance information become available.

-

Click (or tap) the Plan link.

The Insurance Carriers page opens, and displays the options for editing the insurance plan.

-

Click (or tap) Coverage Table.

The Coverage Table dialog box appears.

-

Click (or tap) Manage Exceptions.

The Manage Exceptions dialog box appears.

-

In the Exceptions list, expand a Code to view the corresponding exceptions, and then select an exception.

Notes:

-

To search for a procedure code, begin entering a code in the Search for a procedure by code box, and continue typing as needed to narrow the list.

-

If at least one Code is expanded, to quickly collapse them all, click (or tap) Collapse All. If they are all collapsed, to expand them all, click (or tap) Expand All.

The Edit Exception dialog box appears.

-

-

Set up the options on the following tabs as needed:

-

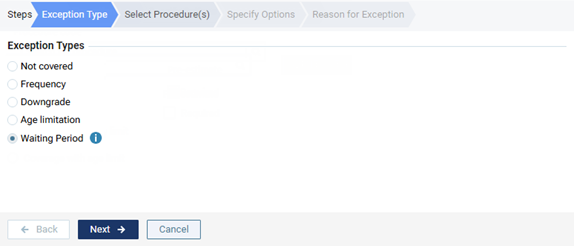

Exception Type

-

Select one of the following options:

-

Not covered - To add procedures that are not covered.

-

Frequency - To add procedures that are covered at certain intervals.

-

Downgrade - To add a procedure that requires a downgrade.

-

Age limitation - To add procedures that have an age limitation.

-

Waiting Period - To add procedures that have a waiting period.

Note: Currently, this exception type is for reference purposes only and not used for insurance estimate calculations.

-

-

Click (or tap) Next.

-

-

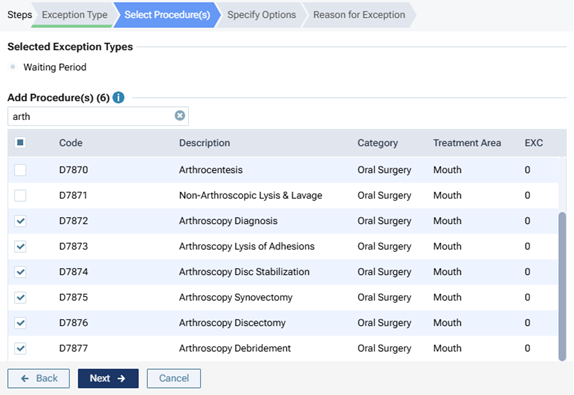

Select Procedure(s)

-

Do one of the following:

-

For a "Not covered" exception type, select the check boxes that correspond to the procedure codes that are not covered.

Notes:

-

Only the procedure codes that do not have any exceptions are available for selection.

-

To quickly select or clear all check boxes, select or clear the check box in the header at the top of the list.

-

To quickly select or clear a range of check boxes, click (or tap) the first check box of the desired range, and then, while pressing the Shift key, click (or tap) the last check box of the desired range.

-

-

For a "Frequency" exception type, select the checkboxes that correspond to the procedure codes that are covered at certain intervals.

Notes:

-

Only the procedure codes that do not have a "Not covered" exception are available for selection.

-

If a "Frequency" exception already exists for a selected procedure, with that procedure's checkbox selected for this new exception, the existing "Frequency" exception for that procedure will be replaced with this new exception.

-

To quickly select or clear all checkboxes, select or clear the checkbox in the header at the top of the list.

-

To quickly select or clear a range of checkboxes, click (or tap) the first checkbox of the desired range, and then, while pressing the Shift key, click (or tap) the last checkbox of the desired range.

-

-

For a "Downgrade" exception type, select the procedure code that requires a downgrade.

Note: Only the procedure codes that do not have a "Not covered" or "Downgrade" exception are available for selection.

-

For an "Age limitation" exception type, select the check boxes that correspond to the procedure codes that have an age limitation.

Notes:

-

Only the procedure codes that do not have a "Not covered" exception are available for selection.

-

If an "Age limitation" exception already exists for a selected procedure, with that procedure's checkbox selected for this new exception, the existing "Age limitation" exception for that procedure will be replaced with this new exception.

-

To quickly select or clear all check boxes, select or clear the check box in the header at the top of the list.

-

To quickly select or clear a range of check boxes, click (or tap) the first check box of the desired range, and then, while pressing the Shift key, click (or tap) the last check box of the desired range.

-

-

For a "Waiting Period" exception type, select the checkboxes that correspond to the procedure codes that have a waiting period.

Notes:

-

Only the procedure codes that do not have a "Not covered" exception are available for selection.

-

If a "Waiting Period" exception already exists for a selected procedure, with that procedure's checkbox selected for this new exception, the existing "Waiting Period" exception for that procedure will be replaced with this new exception.

-

To quickly select or clear all checkboxes, select or clear the checkbox in the header at the top of the list.

-

To quickly select or clear a range of checkboxes, click (or tap) the first checkbox of the desired range, and then, while pressing the Shift key, click (or tap) the last checkbox of the desired range.

-

Notes:

-

To search for a procedure, begin entering the code or its description in the Search for procedure box, continue typing as needed to narrow down the procedure code list.

-

After searching for and selecting a procedure, to return to viewing the entire procedure code list, delete the search text from the Search for procedure box.

-

-

Click (or tap) Next.

-

-

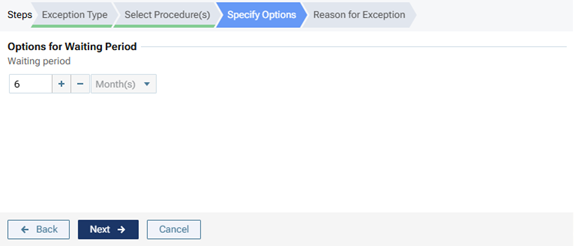

Specify Options

-

Do one of the following:

-

For a "Not covered" exception type, there are no options on this tab.

-

For a "Frequency" exception type, specify how often the insurance carrier covers this procedure within a given time period. For How many times, either enter a number, or click (or tap) + or - to change the number. For Over the course of, enter a number, and then select Year(s), Month(s), or Day(s) from the list.

Notes:

-

When you treatment plan a selected procedure for this exception, Dentrix Ascend takes the specified frequency limitation and the procedure date and coverage start date into account when it calculates an insurance estimate. For example, if procedure A was performed one year ago, and there is a once-every-two-years frequency limitation allowed by insurance for procedure A, if you treatment plan procedure A today, Dentrix Ascend looks back two years from today (assuming the start date of the patient’s insurance plan coverage is at least that far back) and recognizes that the previous posting of procedure A was rendered less than two years ago, so today’s planning of procedure A is seen as not covered. In this case, the estimated insurance portion is calculated as $0.00.

-

However, if a treatment area (such as tooth, quadrant, or arch) applies to a selected procedure for this exception, when you treatment plan that procedure, Dentrix Ascend takes the specified frequency limitation and treatment area into account when it calculates an insurance estimate. For example, if procedure A for the UL quadrant was performed three months ago, and there is a yearly frequency limitation allowed by insurance for procedure A if it is performed on the same treatment area, if you treatment plan procedure A for the UR quadrant today, Dentrix Ascend recognizes that the previous posting of procedure A was rendered on a different treatment area from the treatment area for today’s planning of procedure A, so the correct estimated insurance portion is calculated instead of $0.00.

-

-

For a "Downgrade" exception type, in the Downgrade to search box, begin entering the code or description of the substitute procedure, continue typing as needed to narrow the results, and then select the correct code.

-

For an "Age limitation" exception type, set up the following options:

-

Age limitation - Enter a minimum age limit (as young as 0 years) and a maximum age limit (as old as 110+ years) to specify that the insurance carrier covers this procedure only for patients whose age is within the specified limit. Also, you can use the left slider to change the minimum age and the right slider to change the maximum age.

Note: If the patient's age is not within the specified limit, the percentage (%) or copayment ($) in the coverage table is used.

-

Coverage, % or Downgrade - Do one of the following:

-

Specify a coverage percentage - Select the Coverage, % option. In the box, enter the percentage of the fee charged that the insurance carrier covers for this procedure.

Note: The Coverage, % box is available only for coverage tables that are based on insurance coverage percentages.

-

Specify a downgrade - Select the Downgrade to option. In the Search for procedure box, begin entering the code or description of the substitute procedure, continue typing as needed to narrow the results, and then select the correct code.

-

-

Copayment, $ or Downgrade - Do one of the following:

-

Specify a copayment - Select the Copayment, $ option. Enter the co-pay that the patient pays for this procedure.

Note: The Copayment, $ box is available only for coverage tables that are based on fixed, patient copayments.

-

Specify a downgrade - Select the Downgrade to option. In the Search for procedure box, begin entering the code or description of the substitute procedure, continue typing as needed to narrow the results, and then select the correct code.

-

-

Deductible Type - If the patient must pay a deductible for this procedure, select this check box, and then select the correct type of deductible from the corresponding list.

Note: The Deductible Type check box is available only if the Coverage, % or Copayment, $ option is selected.

-

-

For a "Waiting Period" exception type, specify the length of the waiting period that is required for the insurance carrier to cover this procedure. For the box, either enter a number, or click (or tap) + or - to change the number. From the list, select Year(s), Month(s), Week(s) or Day(s) from the list.

Note: Currently, this exception type is for reference purposes only and not used for insurance estimate calculations.

-

-

Click (or tap) Next.

-

-

Reason for Exception

In the box, enter the reason for the exception in coverage for this procedure.

-

-

Click (or tap) Done.

Note: This button is available only if the Reason for Exception tab is selected.

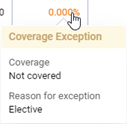

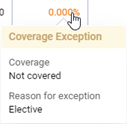

Viewing coverage exceptions from the Ledger

-

On the patient's Ledger page, click (or tap) the amount in the Patient Portion box.

-

On the Detailed View tab of the Patient Portion or Guarantor Portion page, check for coverage exceptions in the following columns:

-

Primary Coverage, % - The percent covered according to the primary insurance plan's coverage table. If the percent is a link, you can click (or tap) it to view the applicable coverage exception.

-

Primary Copayment, $ - The copay according to the primary insurance plan's coverage table. If the amount is a link, you can click (or tap) it to view the applicable coverage exception.

-

Secondary Coverage, % - The percent covered according to the secondary insurance plan's coverage table. If the percent is a link, you can click (or tap) it to view the applicable coverage exception.

-

Secondary Copayment, $ - The copay according to the secondary insurance plan's coverage table. If the amount is a link, you can click (or tap) it to view the applicable coverage exception.

-

Deductibles and Benefits

Check the deductibles (required and met) and benefits (maximum and used) of the patient's insurance plan.

Viewing and editing the required deductibles and maximum benefits

-

On the patient's Insurance Information page, select an insurance plan.

The options for editing insurance information become available.

-

Click (or tap) the Plan link.

The Insurance Carriers page opens, and displays the options for editing the insurance plan.

-

Click (or tap) Benefits.

The Deductibles and Benefits dialog box appears.

-

Change the deductibles and benefits of the plan as needed.

Notes:

-

If there is only one deductible, do one of the following:

-

If the deductible does not apply for preventive procedures - Enter the deductible in the Basic or Major box in each column (Annual Individual, Annual Family, and Lifetime Individual) as applicable. Then, make sure all non-preventive procedures in the coverage table are associated with the deductible type that you entered an amount for.

-

If the deductible does apply for preventive procedures - Enter the deductible in the Preventive, Basic, or Major box in each column (Annual Individual, Annual Family, and Lifetime Individual) as applicable. Then, make sure all procedures in the coverage table are associated with the deductible type that you entered an amount for.

-

-

Currently, the benefit information for Annual Individual Implant and Lifetime Individual Implant is for informational purposes only. The values are not used to calculate insurance estimates.

-

-

Click (or tap) Save.

Viewing and editing the met deductibles and used benefits

-

On the patient's Insurance Information page, select an insurance plan.

The options for editing insurance information become available.

-

Click (or tap) Benefits.

The Deductibles and Benefits dialog box appears.

-

As needed, for the Current Year and/or Previous Year, enter or change any Met amounts for Deductibles and/or Used amounts for Benefits.

Note: Currently, the benefit information for Annual Individual Implant and Lifetime Individual Implant is for informational purposes only. The values are not used to calculate insurance estimates.

-

Click (or tap) Save.

Viewing remaining deductibles and benefits from the Ledger

-

On the patient's Ledger page, click (or tap) the amount in the Patient Portion box.

-

On the Detailed View tab of the Patient Portion or Guarantor Portion page, view the calculated remaining deductibles and benefits in the following columns:

-

Primary Deductibles Remaining - The unmet portion of the primary insurance plan's deductible that is to be paid by the patient.

-

Primary Insurance Portion Remaining - The estimated primary insurance portion. If the amount is a link, you can click (or tap) it to view the remaining primary plan benefits prior to the primary insurance carrier paying for the charge but after what is expected to be paid by the primary insurance carrier for any outstanding charges listed before this charge.

-

Secondary Deductibles Remaining - The unmet portion of the secondary insurance plan's deductible that is to be paid by the patient.

-

Secondary Insurance Portion Remaining - The estimated secondary insurance portion. If the amount is a link, you can click (or tap) it to view the remaining secondary plan benefits prior to the secondary insurance carrier paying for the charge but after what is expected to be paid by the secondary insurance carrier for any outstanding charges listed before this charge.

-

Insurance Defaults

Billing provider

Important: The rendering provider may be different from the billing provider. For the insurance estimates to be calculated correctly, the billing provider must be contracted with the insurance carrier that provides the patient's insurance plan (PPO or DHMO plan only).

Verify the billing provider:

-

If you are not already viewing the correct location, select it on the Location menu.

-

On the Settings menu, under Production, click (or tap) Insurance Defaults.

The Insurance Defaults page opens.

-

Set up the following option:

-

Billing Provider - By default, services will be billed to an insurance plan on behalf of a specific provider (select one), a location in your organization or a business entity (select one if set up as a billing provider), or the provider who performed the procedures. If you select Provider of Procedures, to handle cases where the provider of a procedure is a secondary provider (for example, a hygienist), make sure that you select the primary provider or location/entity that you want to use as the alternate billing provider.

Note: Only the the providers who have access to the current location and the locations/entities that are set up as billing providers are available for selection.

Important: If a provider or location/entity is a billing provider on claims, the address associated with the provider or location/entity cannot include a P.O. Box.

-

-

Click (or tap) Save.

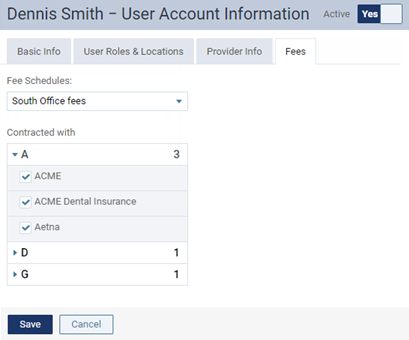

Provider

Fees

If the billing provider is a user, verify if the provider is contracted with the carrier

Important: The rendering provider may be different from the billing provider. For the insurance estimates to be calculated correctly, the billing provider must be contracted with the insurance carrier that provides the patient's insurance plan (PPO or DHMO plan only).

Do the following to verify the provider's contract status:

-

On the Settings menu, under Location, click (or tap) User Accounts.

The User Accounts page opens.

-

On the User Accounts page, select the billing provider's user account.

The options for editing the user account become available.

-

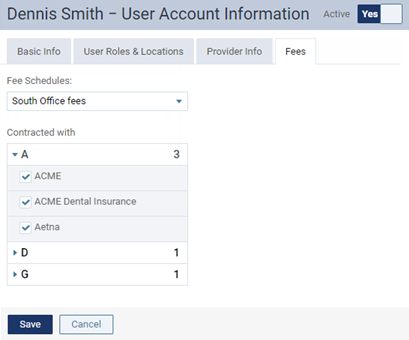

On the Fees tab, under Contracted With, as needed, expand the section that corresponds to the first letter or number that the carrier's name starts with (for example, A, D, and P), and then verify if the checkbox next to that carrier is selected.

-

Select or clear the checkbox as needed.

-

Click (or tap) Save.

Verify if the rendering provider has a preferred fee schedule

-

On the Settings menu, under Location, click (or tap) User Accounts.

The User Accounts page opens.

-

On the User Accounts page, select the rendering provider's user account.

The options for editing the user account become available.

-

On the Fees tab, verify if a fee schedule is selected in the Fee Schedules list, and if so, if it is the correct one.

-

Select or change the fee schedule as needed.

-

Click (or tap) Save.

Location

Fees

If the billing provider is a location (or entity), verify if the location is contracted with the carrier

Important: The rendering provider may be different from the billing provider. For the insurance estimates to be calculated correctly, the billing provider must be contracted with the insurance carrier that provides the patient's insurance plan (PPO or DHMO plan only).

Do the following to verify the location's contract status:

-

If you are not already viewing the correct location, select it on the Location menu.

-

On the Settings menu, under Location, click (or tap) Location Information.

The Location Information page opens.

-

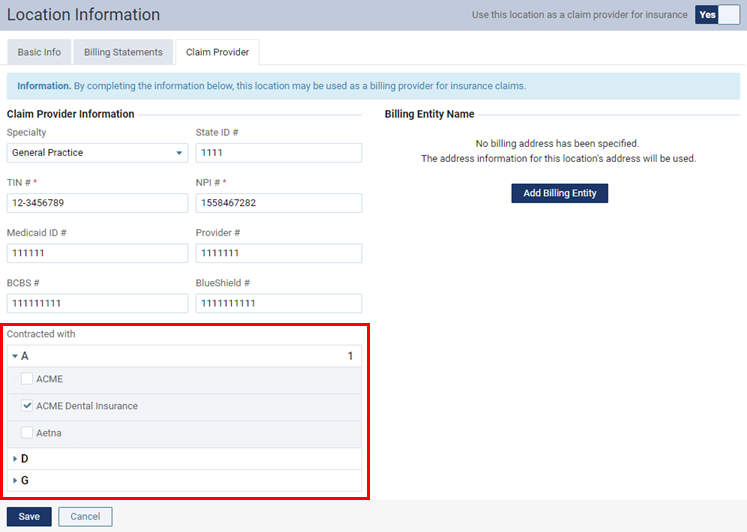

On the Claim Provider tab, for Contracted With, as needed, expand the section that corresponds to the first letter or number that the carrier's name starts with (for example, A, D, and P), and then verify if the checkbox next to that carrier is selected.

Note: The Claim Provider tab is available only if the Use this location as a claim provider for insurance switch is set to Yes.

-

Select or clear the checkbox as needed.

-

Click (or tap) Save.

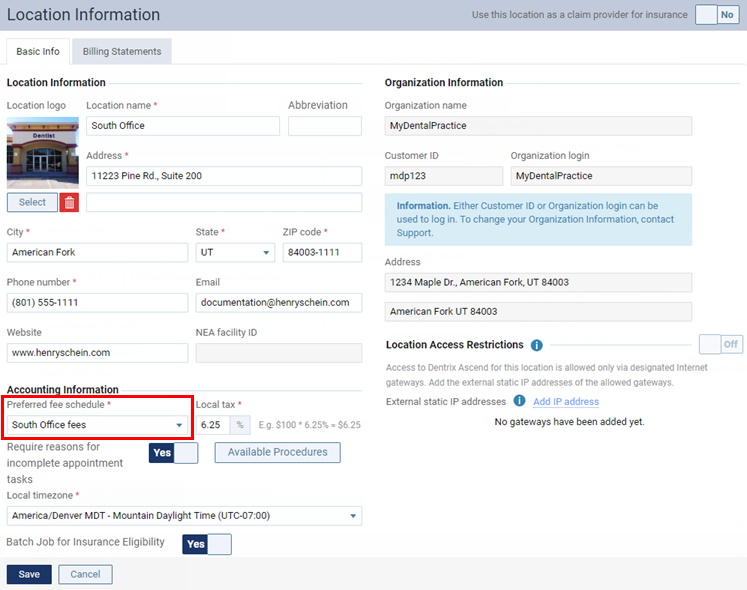

Verify the location's preferred fee schedule

-

If you are not already viewing the correct location, select it on the Location menu.

-

On the Settings menu, under Location, click (or tap) Location Information.

The Location Information page opens.

-

Verify that the correct fee schedule is selected in the Preferred fee schedule list.

-

Click (or tap) Save.

Insurance plan

Contracted fee schedule and coordination of benefits

-

On the patient's Insurance Information page, select an insurance plan.

The options for editing insurance information become available.

-

Click (or tap) the Plan link.

The Insurance Carriers page opens, and displays the options for editing the insurance plan.

-

Set up the following options:

-

Source of Payment - The type of insurance company that will remit payment: CHAMPUS, Blue Cross/Blue Shield, Commercial Insurance, Commercial Insurance (PPO), Commercial Insurance (DHMO), Medicare Part B, or Medicaid.

-

Max allowable amount fee schedule - The schedule of allowed charges for the insurance plan (PPO or DHMO plan only). The selected fee schedule will be used to determine a patient's portion and the recommended write-off.

Important: For each provider (and each location that is set up as a billing provider for claims) who participates with this insurance plan, in that provider's user account (or that location's settings), you must select this carrier in the Contracted With section.

Note: When you expand the list, you can use the search box at the top to quickly locate a fee schedule. Begin typing part of a fee schedule name in the box to see the matching fee schedules in the list. Continue typing as needed to narrow down the results. Select the correct fee schedule.

You can also click (or tap) Max Allowable All Locations to open the Max Allowable Amount Fee Schedules By Location dialog box and set the max allowable fee schedule for the insurance plan by location.

-

Coordination of Benefits - The methods for handling the Coordination of Benefits (COB) between primary and secondary insurance claims for a patient with this insurance plan as his or her secondary plan. Click (or tap) Coordination of Benefits to open the Coordination of Benefits for dialog box.

For each Source of Payment for Primary Insurance Plan, select a Method for Coordination of Benefits, and then click (or tap) Save.

Notes:

-

If this insurance plan is attached to a patient's record as a secondary plan, the method being used for coordinating benefits appears on the patient's Insurance Information page when the options for the secondary plan are being displayed.

-

For more information about the coordination of benefits, refer to the topic about Coordination of benefits.

-

Changing the coordination of benefits for insurance plans requires the "Edit Insurance Plans" security right.

-

-

-

Click (or tap) Save.

Viewing contracted fees from the Ledger

-

On the patient's Ledger page, click (or tap) the amount in the Patient Portion box.

-

On the Detailed View tab of the Patient Portion or Guarantor Portion page, check for contracted fees in the following columns:

-

Primary Allowable Amount - The contracted amount according to the primary insurance plan's fee schedule.

-

Secondary Allowable Amount - The contracted amount according to the secondary insurance plan's fee schedule.

-

Fee schedules

Hierarchy

Note: The procedure Amount comes from the rendering provider's preferred fee schedule unless the provider does not have one, in which case, the amount comes from the location's preferred fee schedule.

Verify the procedure amount in any of the following fee schedules:

-

The insurance plan's Max allowable amount fee schedule

-

The rendering provider's preferred Fee Schedule

-

The location's Preferred fee schedule

Viewing and editing fee schedules

-

On the Settings menu, under Production, click (or tap) Fee Schedules.

The Fee Schedules page opens.

Note: To search for a fee schedule, begin typing part of the name of a fee schedule in the Search for Fee Schedule box, and continue typing as needed to narrow down the list.

-

Select a fee schedule.

The options for editing the fee schedule become available.

-

If the fee schedule has multiple versions, select the version that you want to update from the Fee schedule version list. This list is available only if the fee schedule has multiple versions.

-

Do any of the following as needed:

-

Change the name of the fee schedule in the Name of fee schedule box.

-

To set the end date for the fee schedule and make a new version of the fee schedule that will become effective after the specified date, do the following:

-

Click (or tap) Set End Date.

The Set End Date for This Version of the Fee Schedule dialog box appears.

-

If this is not the first version of the fee schedule, specify the Start date. This box is available only if there is an existing previous version. Changing the start date affects the end date of the previous version.

-

Specify the End date. The next version will become effective on the day after the specified end date for this version. If there is an existing next version, changing the end date for this version affects the start date of the next version.

-

Click (or tap) Set & Save. Ignore step 5 unless you are going to make changes to the fees of any version of the fee schedule.

Notes regarding multiple versions:

-

A procedure with an Other status uses the version of a fee schedule that is effective on the date of the appointment. This affects scheduled production.

-

A procedure with a Tx Plan status uses the version of a fee schedule that is effective on the date of the procedure. This affects scheduled production if the procedure is attached to an appointment.

-

An insurance estimate is determined from the version of a fee schedule that is effective on the service date of the procedure for which the calculation is being made.

-

A write-off is determined from the version of a fee schedule that is effective on the service date of the procedure for which the calculation is being made.

-

The day sheet, aged receivables, and outstanding claims reports determine production from the versions of fee schedules that are effective on the service dates of the procedures being reported on.

-

-

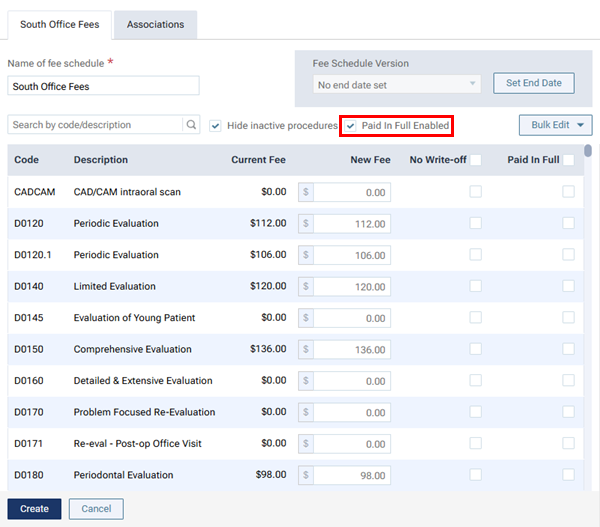

To enable or disable "Paid in Full" procedures for the fee schedule, select or clear the Paid in Full Enabled checkbox. With this checkbox selected, a Paid in Full column is available for the list of procedures.

Note: The selecting of this checkbox is stored in the Audit Log.

-

Optionally, to import fees from a .csv file, on the Bulk Edit menu, select Import fees from file.

-

To increase or decrease all the fees in the fee schedule by the same amount or percentage, do the following:

-

On the Bulk Edit menu, select Increase all by.

The Bulk Edit - Increase All dialog box appears.

-

Enter a positive or negative number (for example, 20 or -20; also, decimals are allowed), and then select $ or %.

-

Select the Round up resulting values to the nearest dollar checkbox if you want to round up the new fees.

-

If you are increasing fees, to ignore any current fees with a $0.00 amount (they will stay at $0.00; only non-zero fees will be increased), select the Exclude $0.00 fees from increase checkbox.

-

Click (or tap) Proceed. The resulting fees appear in the New Fee column.

-

-

For each procedure, do any of the following as needed:

-

In the box in the New Fee column, enter or change the fee that you charge for the procedure.

Note: If this fee schedule is the location's preferred fee schedule, changing the fee of a procedure code here affects the fee for the same procedure code on the location's Procedure Codes page and vice versa.

-

If you do not want to allow an automatic write-off to be posted for the procedure, select the checkbox in the No Write-off column. If you want to allow an automatic write-off to be posted for the procedure, clear the checkbox in the No Write-off column.

Notes:

-

With the No Write-off checkbox selected for the procedure, an automatic write-off can occur for that procedure only if this fee schedule is selected as the Max allowable amount fee schedule for a patient's insurance plan. Also, an automatic write-off cannot occur if a patient's record has a discount plan attached and no insurance coverage is attached.

-

To select or clear every procedure's checkbox (if available) at the same time, select or clear the checkbox at the top of the column.

-

To select the checkboxes of a range of adjacent procedures, select the first checkbox of the range, and then while holding the Shift key, select the last checkbox of the range. All the checkboxes (if available) from the first one to the last one are selected.

-

If the Paid in Full Enabled checkbox is selected for this fee schedule, the No Write-off checkbox for the procedure is available only if the Paid in Full checkbox for the procedure is clear.

-

-

If the Paid in Full Enabled checkbox is selected for this fee schedule, depending on whether you want the procedure to be marked as a "Paid in Full" procedure or not, select or clear the checkbox in the Paid in Full column.

Notes:

-

With the Paid in Full checkbox selected for the procedure, instead of a patient being responsible for a portion of the charge, anything over the maximum allowed (contracted) rate gets written off. The patient's portion is always $0 for a "Paid in Full" procedure.

-

To select or clear every procedure's checkbox (if available) at the same time, select or clear the checkbox at the top of the column.

-

To select the checkboxes of a range of adjacent procedures, select the first checkbox of the range, and then while holding the Shift key, select the last checkbox of the range. All the checkboxes (if available) from the first one to the last one are selected.

-

The Paid in Full checkbox for the procedure is available only if the No Write-off checkbox for the procedure is clear.

-

Tips:

-

To search for a procedure, begin typing a code or description in the Search by code/description box, and continue typing as needed to narrow down the list of procedures.

-

The Hide inactive procedures checkbox is selected by default, so only active procedures are shown. To temporarily show inactive procedures too, clear this checkbox (the checkbox reverts back to being selected the next time you access the Fee Schedules page and select a fee schedule).

-

-

-

Click (or tap) Save.

Calculations

Insurance estimates

Understanding how insurance estimates are calculated

Dentrix Ascend calculates insurance portions, write-off adjustments, and patient portions automatically. The explanation that follows covers estimates for primary and secondary plans. The same rules and calculations that apply to secondary plans apply to plans for other coverage orders (tertiary, quaternary, and so forth); however, the calculations are not performed automatically.

The commercial insurance plans that Dentrix Ascend supports are PPO (Preferred Provider Organization), DHMO (Dental Health Maintenance Organization), and indemnity.

Notes:

-

Before calculating insurance estimates for procedures posted on the current date, Dentrix Ascend takes into account any pending primary and secondary claims (in the order they were sent, and claims with the highest total billed amount being handled first) for the patient, the subscriber of the patient's plan (if not the same person), and any other dependents on the plan. However, insurance estimates do not take into account a tertiary plan unless a claim for that plan is attached to a secondary claim; likewise, estimates do not take into account a quaternary plan unless a claim for that plan is attached to a tertiary claim; and so forth.

-

Dentrix Ascend processes procedures being billed to insurance chronologically (oldest to newest, by procedure dates), by descending procedure predetermination or override amounts (largest to smallest), and then by descending procedure amounts (largest to smallest).

-

When calculating estimates for an insurance payment, Dentrix Ascend processes only the procedures associated with the current claim. The maximums and deductibles are calculated as if the current claim is the next one to be paid.

-

For Dentrix Ascend to calculate estimates for procedures posted on the current date, the patient must have an active primary insurance plan with coverage dates that include the dates of those posted procedures.

-

Estimates include procedures posted on the current date and prior, even if those procedures are not attached to a claim.

-

The deductible type for multiple procedures posted on the same date is determined by the first procedure.

-

The billing provider, which is determined by the insurance defaults, may be different from the provider who is associated with a procedure.

-

Patient payments and credit adjustments that are applied to procedures reduce the estimated patient portion. Insurance payments that are less than what is expected to be paid reduce the estimated insurance portion and increase the estimated patient portion. Partial insurance payments (more is expected to be paid) reduce the estimated insurance portion.

Estimates for a patient's primary or only insurance plan

Do the following:

-

Calculate the Write-off.

Terms

W

Write-off

Aproc

Amount Charged (the procedure's Amount)

Amax

Max Allowable Amount (from the plan's Max allowable amount fee schedule)

Apay

Payment Table Amount (from the Amount column in the plan's payment table)

Cpat

Patient Copay (from the Copayment $ column in the plan's coverage table)

Do one of the following:

-

If a Max allowable amount fee schedule is selected for the plan, do one of the following:

-

If the billing provider is contracted with the carrier, do one of the following:

-

For a coverage table based on patient copayments ($), take the greater of Amax and Cpat, subtract that greater amount from Aproc, and then set W equal to that difference unless that difference is less than zero, in which case, set W equal to zero.

W = max (0 ; Aproc - max (Amax ; Cpat))

-

For a coverage table based on insurance coverage percentages (%), do one of the following:

-

If a procedure is listed in the payment table, take the greater of Amax and Apay, subtract that greater amount from Aproc, and then set W equal to that difference unless that difference is less than zero, in which case, set W equal to zero.

W = max (0 ; Aproc - max (Amax ; Apay))

-

If a procedure is not listed in the payment table, subtract Amax from Aproc, and then set Wpri equal to that difference unless that difference is less than zero, in which case, set Wpri equal to zero.

W = max (0 ; Aproc - Amax)

-

-

-

If the billing provider is not contracted with the carrier, set W equal to zero.

W = 0

-

-

If a Max allowable amount fee schedule is not selected for the plan, there is not a Write-off, so set W equal to zero.

W = 0

-

-

Calculate the Remaining Deductible.

Term

Drem

Remaining Deductible

Note: No value or a zero (0) for a required deductible both indicate that no deductible is required.

-

Do one of the following:

-

For an orthodontic procedure, do the following:

-

Calculate the Remaining Annual Individual Ortho Deductible:

Terms

AIODreq

Required Annual Individual Ortho Deductible

AIODmet

Met Annual Individual Ortho Deductible

AIODrem

Remaining Annual Individual Ortho Deductible

-

If AIODreq has no value, then AIODrem = 0

-

If AIODreq = 0, then AIODrem = 0

-

If AIODreq > 0, then AIODrem = AIODreq - AIODmet

-

-

Set the Remaining Deductible (Drem) equal to the Remaining Annual Individual Ortho Deductible (AIODrem).

Drem = AIODrem

-

-

For a non-orthodontic procedure, do the following:

-

For the Lifetime Individual Deductible, calculate the Remaining Lifetime Individual Deductible:

Terms

LIDreq

Required Lifetime Individual Deductible

LIDmet

Met Lifetime Individual Deductible

LIDrem

Remaining Lifetime Individual Deductible

-

If LIDreq has no value, then LIDrem = 0

-

If LIDreq = 0, then LIDrem = 0

-

If LIDreq > 0, then LIDrem = LIDreq - LIDmet

-

-

For the Annual Family Deductible, calculate the Remaining Annual Family Deductible:

Terms

AFDreq

Required Annual Family Deductible

AFDmet

Met Annual Family Deductible

AFDrem

Remaining Annual Family Deductible

-

If AFDreq has no value, then AFDrem = 0

-

If AFDreq = 0, then AFDrem = 0

-

If AFDreq > 0, then AFDrem = AFDreq - AFDmet

-

-

For the Annual Individual Deductible, calculate the Remaining Annual Individual Deductible:

Terms

AIDreq

Required Annual Individual Deductible

AIDmet

Met Annual Individual Deductible

AIDrem

Remaining Annual Individual Deductible

-

If AIDreq has no value, then AIDrem = 0

-

If AIDreq = 0, then AIDrem = 0

-

If AIDreq > 0, then AIDrem = AIDreq - AIDmet

-

-

Calculate the Remaining Deductible. Take the lesser of LIDrem, AFDrem, and AIDrem, and set Drem equal to that lesser amount.

Drem = min (LIDrem ; AFDrem ; AIDrem)

-

-

-

-

Calculate the Insurance Portion.

Terms

I

Insurance Portion

Aproc

Amount Charged (the procedure's Amount)

Amax

Max Allowable Amount (from the plan's Max allowable amount fee schedule)

Amin

Min Allowable Amount

Apay

Payment Table Amount (from the Amount column in the plan's payment table)

Cpat

Patient Copay (from the Copayment $ column in the plan's coverage table)

Cins

Insurance Coverage Percentage (from the Coverage % column in the plan's coverage table)

Cexc

Patient Copay Exception or Insurance Coverage Exception (any applicable exceptions, as indicated in the EXC column, in the plan's coverage table)

Oins

Insurance Estimate Override (from the procedure's Insurance Estimate Overrides; entered and locked automatically, or entered manually)

Do one of the following:

-

If a Max allowable amount fee schedule is selected for the plan, do the following:

-

Calculate the Min Allowable. Because the calculations for the Insurance Portion require that Amax not exceed Aproc, take the lesser of Aproc and Amax, and then set Amin equal to that lesser amount.

Amin = min (Aproc ; Amax)

-

Calculate the Insurance Portion. Do one of the following:

-

Without an Insurance Estimate Override, do one of the following:

-

For a coverage table based on patient copayments, do the following:

-

Determine the Patient Copay. Do one of the following:

-

If there is an exception for the procedure in the coverage table, it is ignored currently. Use the default copay.

Cpat = Cpat

-

If there is not an exception for the procedure in the coverage table, use the default copay.

Cpat = Cpat

-

-

Calculate the Insurance Portion. Subtract Cpat from Amin, and then set I equal to that difference unless that difference is less than zero, in which case, set I equal to zero.

I = max (0 ; Amin - Cpat)

-

-

For a coverage table based on insurance coverage percentages, do one of the following:

-

If a procedure is listed in the payment table, take the greater of Amin and Apay, and then set I equal to that greater amount.

I = max (Amin ; Apay)

-

If a procedure is not listed in the payment table, do the following:

-

Determine the Insurance Coverage Percentage. Do one of the following:

-