Coordination of benefits

Dentrix Ascend provides three options for coordinating benefits between primary and secondary insurance claims.

Note: For a detailed, technical explanation of insurance calculations, which includes coordination of benefits, refer to the topic about insurance estimates.

To set up the coordination of benefits (COB)

-

The method that will be used for handling the coordination of benefits depends on the source of payment for a patient's primary insurance plan. When you are adding or updating an insurance plan, select the correct Source of Payment.

-

When you are adding or updating an insurance plan, to specify the methods for handling the coordination of benefits for a patient with this insurance plan as his or her secondary plan, do the following:

-

Click (or tap) Coordination of Benefits.

The Coordination of Benefits for dialog box appears.

-

For each Source of Payment for Primary Insurance Plan, select a Method for Coordination of Benefits:

-

Traditional - The maximum allowed fee multiplied by the coverage table percentage for the primary and secondary plans up to the full amount of the UCR Fee/charge.

-

Maintenance of benefits - Primary calculated normally. Secondary max allow amount has primary paid portion subtracted before being multiplied by coverage table. That amount is expected from insurance. Any amount remaining up to the lowest contracted fee goes to the guarantor portion. Above that lowest in network max allowed fee is written off.

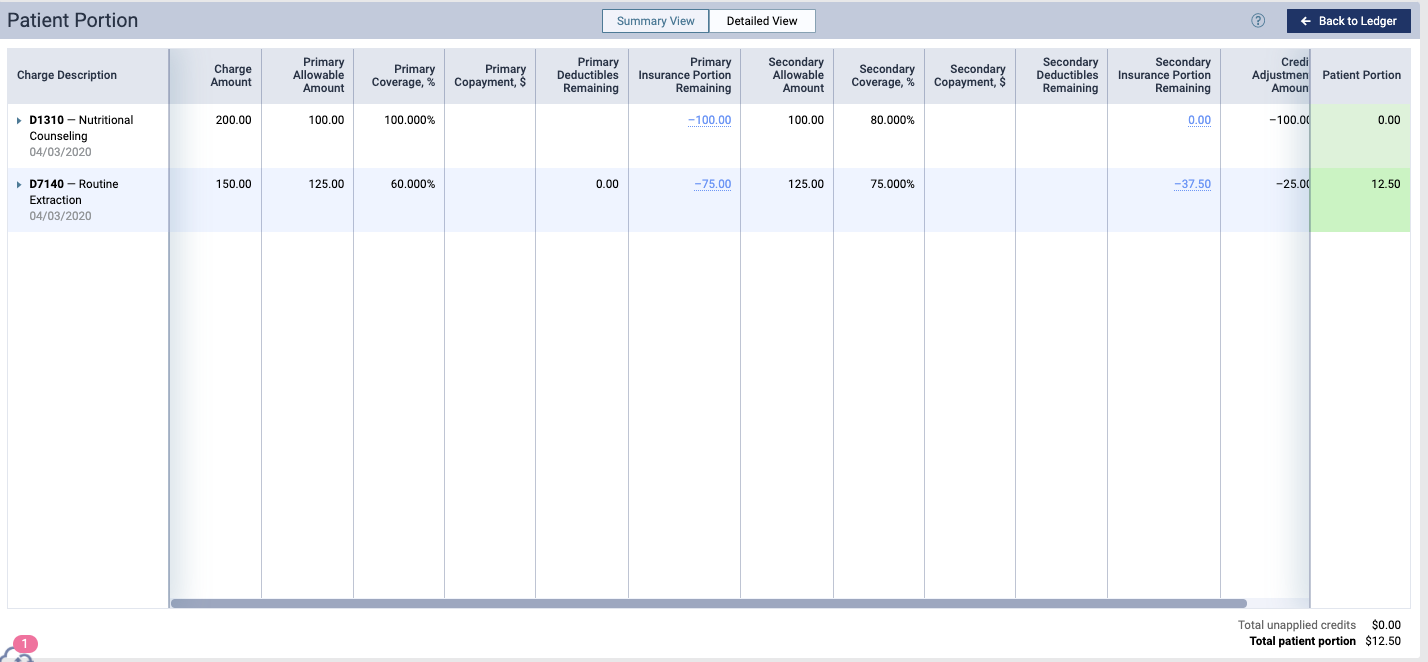

In this example, the second procedure the primary paid $75. Deduct that from the $125 amount for the secondary allowable amount leaving $75. That multiplied by the coverage table of 75% results in a secondary insurance payment of $37.50. $12.50 goes to the guarantor portion and $25 is written off.

-

Carve Out/Non Duplication - Primary calculated normally. Secondary is calculated normally and that amount has from it subtracted the amount paid by the primary. The remainder is estimated from insurance. Any amount remaining after primary and secondary payment amounts are combined up to the contracted fee are moved to the guarantor portion. Above the contracted fee for in network carriers is written off.

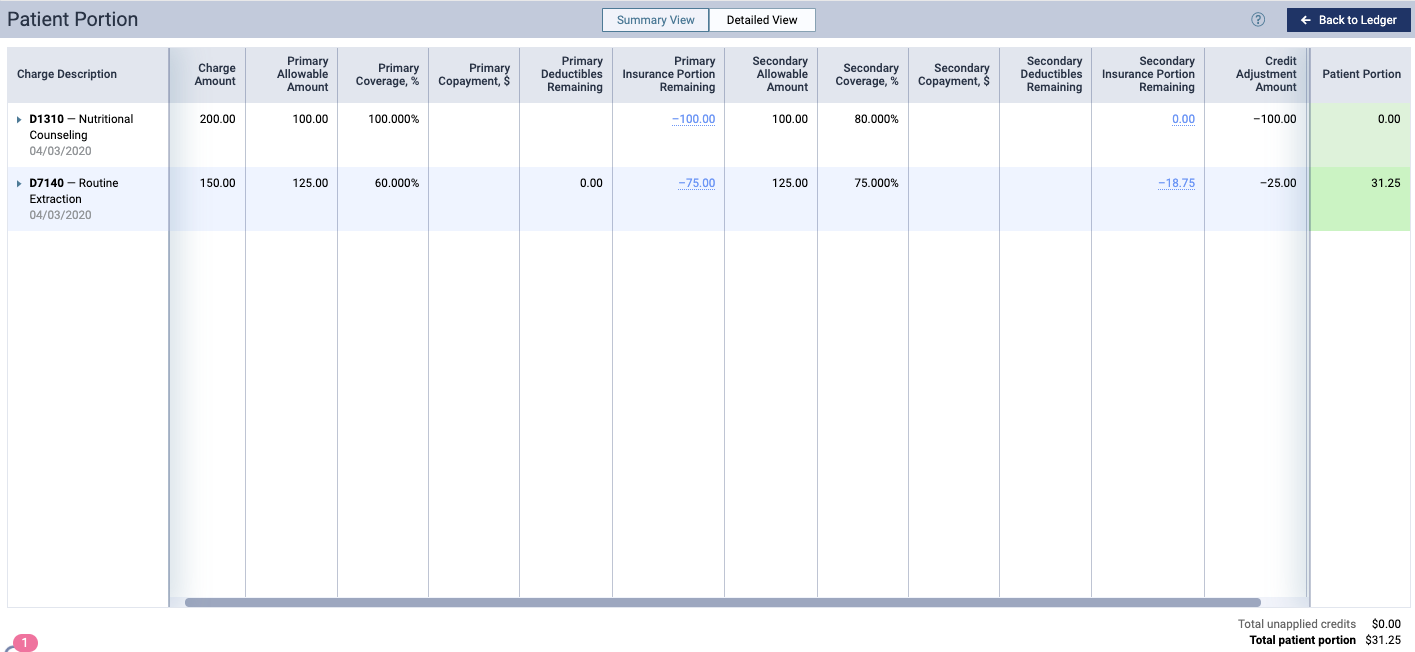

In this example, the secondary is estimated to pay 75% of the $125 contracted fee, which is $93.75. When the amount the primary is subtracted from that amount, the balance is greater than 0, so that becomes the insurance estimate ($93.75-$75=$18.75) The amount between the UCR and contracted fee is written off. The difference between both insurance payments and the lowest contracted fee moves to the guarantor portion ($25 write off and $31.25 guarantor portion).

-

-

Click (or tap) Save.

Note: If this insurance plan is attached to a patient's record as a secondary plan, the method being used for coordinating benefits appears on the patient's Insurance Information page when the options for the secondary plan are being displayed.

-