Dentrix Enterprise can help you reallocate amounts for procedures on a claim, with and without adjustments, when you are entering an insurance payment that results in an overpayment. An overpayment can happen when the payment amount exceeds the allocated amount and/or the estimated insurance portion exceeds the allocated amount. Also, you can customize the global settings that handle this functionality to suit your preferences.

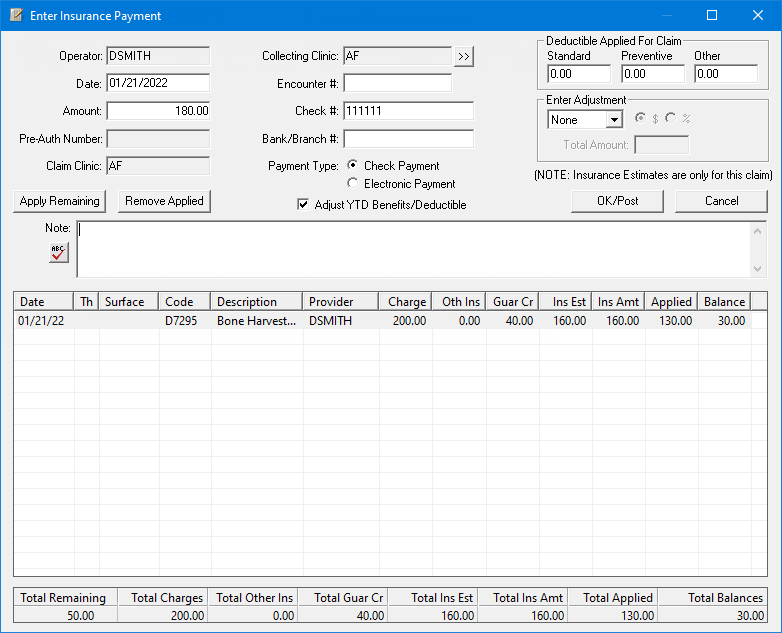

Note: Use the procedure and payment information in the following scenario to help you understand the terms and calculations explained thereafter.

Procedure: |

Charge = $200 |

Guar Est = $40 |

Ins Est = $160 |

Guarantor Payment: |

Amount = $40 |

Applied = $40 |

|

Insurance Payment: |

Amount = $180 |

|

Applied = $130 |

Terms and Calculations: It is important to understand the following terms since they will be referenced throughout this topic. (For bold items, refer to the Enter Insurance Payment dialog box.)

Insurance Amount Applied:

The portion of the insurance payment applied to the procedures on the claim

(Total Applied). For example,

Insurance Amount Applied = $130.

Insurance Overpayment:

The unapplied portion of the insurance payment (Total

Remaining, which is Amount

- Total Applied). For example,

Insurance Overpayment = $50 ($180

- $130).

Insurance Estimate:

The estimated insurance coverage (Total

Ins Est). For example, Insurance

Estimate = $160.

Insurance Under Allocation:

The remainder of the estimated insurance portion after applying all or

a portion of the insurance payment to the procedures on the claim (Total Balances, which is Total

Ins Est - Total Applied).

For example, Insurance Under Allocation

= $30 ($160 - $130).

Guarantor Amount Applied:

The portion of guarantor payments applied to the procedures on the claim

(Total Guar Cr). For example,

Guarantor Amount Applied = $40.

To handle an insurance overpayment

In the Enter Insurance Payment dialog box, enter the details of a dental insurance payment or a medical insurance payment, including the following:

Amount - Enter the payment amount.

Applied - According to the EOB you received from the insurance carrier, change the applied amount for each procedure on the claim as needed.

Notes:

If the payment Amount is greater than the Total Applied amount, this is an overpayment (Insurance Overpayment).

If the Total Ins Est is greater than the Total Applied amount, this is an under allocation (Insurance Under Allocation).

If the Total Guar Cr is greater than zero, this is the guarantor amount applied (Guarantor Amount Applied).

Click OK/Post.

The dialog box (or message) that appears depends on certain global settings, if there is an Insurance Overpayment and/or an Insurance Under Allocation, and if there is a Guarantor Amount Applied.

Do one of the following:

Option Set 1 - Using the following global settings (this is the default):

Post Adjs for Ins Overpayments - Disabled

Post Adjs for Ins Underallocations - Disabled

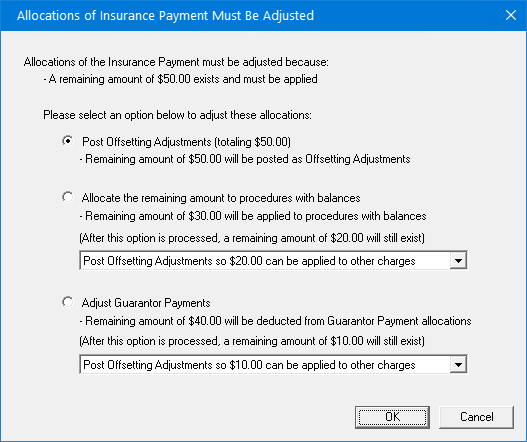

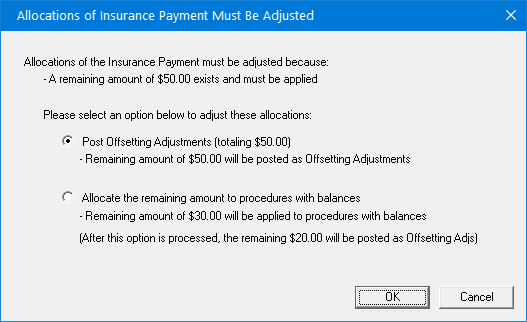

If there is an Insurance Overpayment and/or an Insurance Under Allocation, the Allocations of Insurance Payment Must Be Adjusted dialog box appears.

Select one of the following options:

Post Offsetting Adjustments - Post offsetting adjustments, each for the amount of the Insurance Overpayment (recommended for tracking purposes):

The credit (-) adjustment will be associated with the claim but not applied to the procedures. The resulting suspended credit on the account can be applied to other charges.

The charge (+) adjustment will be applied to the claim.

Note: Any Guarantor Amount Applied will not be affected.

Allocate the remaining amount to procedures with balances - If there is an Insurance Under Allocation, apply that amount to the procedures on the claim; otherwise, apply the Insurance Overpayment.

Also, if the Insurance Under Allocation is applied, and there is still a remaining amount, choose what to do with it (the list with the following options is available only if there is a remaining amount):

Post Offsetting Adjustments so [$] can be applied to other charges - Post offsetting adjustments, each for the remaining amount:

The credit (-) adjustment will be associated with the claim but not applied to the procedures. The resulting suspended credit on the account can be applied to other charges.

The charge (+) adjustment will be applied to the claim.

Note: Any Guarantor Amount Applied will not be affected.

Unallocate [$] from Guarantor Payments and apply it to this Pmt/Adj - Deduct the remaining amount from the Guarantor Amount Applied (if the corresponding guarantor payment is not in a closed out month), and apply it to the procedures on the claim.

Adjust Guarantor Payments - Remove the Guarantor Amount Applied (if the corresponding guarantor payment is not in a closed out month), and apply that amount to the procedures on the claim (this is existing functionality as in versions prior to 8.0.7 CU3). This option is available only if there is a Guarantor Amount Applied.

Also, if the Guarantor Amount Applied is applied, and there is still a remaining amount, choose what to do with it (the list with the following options is available only if there is a remaining amount):

Post Offsetting Adjustments so [$] can be applied to other charges - Post offsetting adjustments, each for the remaining amount:

The credit (-) adjustment will be associated with the claim but not applied to the procedures. The resulting suspended credit on the account can be applied to other charges.

The charge (+) adjustment will be applied to the claim.

Allocate [$] to procedures with balances - Apply the remaining amount to the procedures on the claim (this is existing functionality as in versions prior to 8.0.7 CU3).

Click OK.

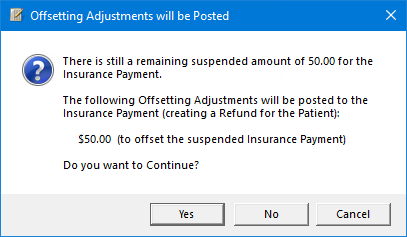

Option Set 2 - Using the following global settings:

Post Adjs for Ins Overpayments - Enabled

Post Adjs for Ins Underallocations - Enabled

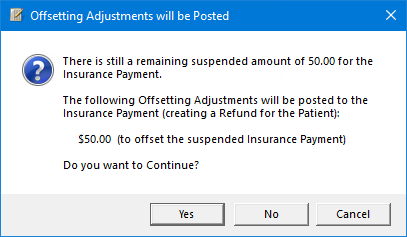

If there is an Insurance Overpayment and/or an Insurance Under Allocation, the Offsetting Adjustments will be Posted message appears.

To post offsetting adjustments, each for the amount of the Insurance Overpayment/Insurance Under Allocation, click Yes.

Notes:

The credit (-) adjustment will be associated with the claim but not applied to the procedures. The resulting suspended credit on the account can be applied to other charges.

The charge (+) adjustment will be applied to the claim.

Any remaining amount that could have been allocated to procedures on the claim will not be applied. Offsetting adjustments, each for the remaining amount, will be posted:

The credit (-) adjustment will be associated with the claim but not applied to the procedures. The resulting suspended credit on the account can be applied to other charges.

The charge (+) adjustment will be applied to the claim.

Any Guarantor Amount Applied will not be affected.

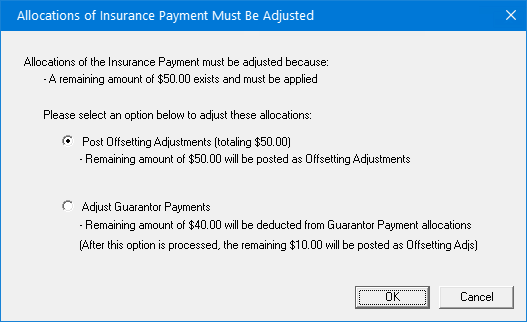

Option Set 3 - Using the following global settings:

Post Adjs for Ins Overpayments - Disabled

Post Adjs for Ins Underallocations - Enabled

Do one of the following:

If there is an Insurance Overpayment and/or an Insurance Under Allocation, and a Guarantor Amount Applied, the Allocations of Insurance Payment Must Be Adjusted dialog box appears.

Select one of the following options:

Post Offsetting Adjustments - Post offsetting adjustments, each for the amount of the Insurance Overpayment:

The credit (-) adjustment will be associated with the claim but not applied to the procedures. The resulting suspended credit on the account can be applied to other charges.

The charge (+) adjustment will be applied to the claim.

Also, any remaining amount that could have been allocated to procedures on the claim will not be applied. Offsetting adjustments, each for the remaining amount, will be posted:

The credit (-) adjustment will be associated with the claim but not applied to the procedures. The resulting suspended credit on the account can be applied to other charges.

The charge (+) adjustment will be applied to the claim.

Note: Any Guarantor Amount Applied will not be affected.

Adjust Guarantor Payments - Remove the Guarantor Amount Applied (if the corresponding guarantor payment is not in a closed out month), and apply that amount to the procedures on the claim.

Also, if the Guarantor Amount Applied is applied, and there is still a remaining amount, offsetting adjustments, each for the remaining amount, will be posted:

The credit (-) adjustment will be associated with the claim but not applied to the procedures. The resulting suspended credit on the account can be applied to other charges.

The charge (+) adjustment will be applied to the claim.

Click OK.

If there is an Insurance Overpayment and/or an Insurance Under Allocation, but not a Guarantor Amount Applied, the Offsetting Adjustments will be Posted message appears.

To post offsetting adjustments, each for the amount of the Insurance Overpayment/Insurance Under Allocation, click Yes.

Notes:

The credit (-) adjustment will be associated with the claim but not applied to the procedures. The resulting suspended credit on the account can be applied to other charges.

The charge (+) adjustment will be applied to the claim.

Any remaining amount that could have been allocated to procedures on the claim will not be applied. Offsetting adjustments, each for the remaining amount, will be posted:

The credit (-) adjustment will be associated with the claim but not applied to the procedures. The resulting suspended credit on the account can be applied to other charges.

The charge (+) adjustment will be applied to the claim.

Any Guarantor Amount Applied will not be affected.

Option Set 4 - Using the following global settings:

Post Adjs for Ins Overpayments - Enabled

Post Adjs for Ins Underallocations - Disabled

If there is an Insurance Overpayment and/or an Insurance Under Allocation, the Allocations of Insurance Payment Must Be Adjusted dialog box appears.

Select one of the following options:

Post Offsetting Adjustments - Post offsetting adjustments, each for the amount of the Insurance Overpayment:

The credit (-) adjustment will be associated with the claim but not applied to the procedures. The resulting suspended credit on the account can be applied to other charges.

The charge (+) adjustment will be applied to the claim.

Also, any remaining amount that could have been allocated to procedures on the claim will not be applied. Offsetting adjustments, each for the remaining amount, will be posted:

The credit (-) adjustment will be associated with the claim but not applied to the procedures. The resulting suspended credit on the account can be applied to other charges.

The charge (+) adjustment will be applied to the claim.

Note: Any Guarantor Amount Applied will not be affected.

Allocate the remaining amount to procedures with balances - If there is an Insurance Under Allocation, apply that amount to the procedures on the claim; otherwise, apply the Insurance Overpayment.

Also, if the Insurance Under Allocation was applied, and there is still a remaining amount, offsetting adjustments, each for the remaining amount, will be posted:

The credit (-) adjustment will be associated with the claim but not applied to the procedures. The resulting suspended credit on the account can be applied to other charges.

The charge (+) adjustment will be applied to the claim.

Note: Any Guarantor Amount Applied will not be affected.

Click OK.