Setting up capitation plans using method 1

Setup: Co-payments are entered in the coverage table.

Daily Use: Est. Insurance Portion lists the dentist’s normal fee, which is also the amount posted to the account when you set the procedure to complete. Est. Patient Portion shows the co-payment as listed in the coverage table, and the insurance column displays the amount written off for each procedure.

When you set procedures to complete, the day’s charges display in the Accounts module automatically, listing the correct amounts to collect from the patient and to adjust off. In the example below, the patient pays $24.40, and $158.60 is adjusted off the account. All calculations are made for you automatically.

Management: You can send the Utilization Report monthly to the carrier as required, and/or you can use the report for utilization management within your practice. For management benefit, the report lists the practice or provider’s normal fee for each procedure completed and co-pay charged and then totals these items for each plan.

Because adjustments are made each time you post charges, Option 1 makes the Adjustment Summary Report available too. This report gives you access to the following useful capitation figures for the selected time period:

· The number of total adjustments made (number of capitation appointments).

· The total amount written off for capitation, and the average amount of each write-off.

To set up a capitation plan using method 1

1. Do one of the following:

· If your practice supports fewer than six capitation plans, create a new billing type for each plan.

Note: If your practice supports more than five plans within a given company, you can select a grouping of several plans and add a billing type for each grouping.

· If your practice services several capitation carriers, add a billing type for each carrier.

Note: Do not use more than five billing types for capitation.

2. Add a new credit (-) adjustment type for each billing type that you created.

3. Create the capitation plans as individual insurance plans in the database.

a. Using Quick Search or Advanced Search select the patient you want to create a capitation plan for, and then click the Insurance tab.

Note: If the insurance plan already exists in the database, you can edit it according to the specifications listed here. If the insurance plan does not exist, create a new one and enter the carrier name, address, and so on.

b. Click Coverage Table.

The Insurance Coverage dialog box appears.

c. Under Coverage Table, click the Select Table search button.

The Select Coverage Table dialog box appears.

d. Select All Procedures (Cap Plan) from the list, and then click OK.

e. Add the correct co-payment for each procedure listed.

Note: For procedures that are covered by the plan but do not have a co-payment, leave the co-payment set to zero. Delete any procedures that are not covered by the plan in order to have your normal fee charged when treatment planning or completing these procedures.

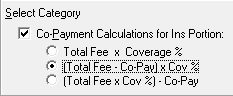

f. Select Co-Payment Calculations for Ins Portion, and then select (Total Fee - Co-pay) x Cov %.

Tip: If you have already entered a capitation plan that has the same or similar co-payments, select this plan for the current subscriber and edit it to create a new plan. A message appears. Select Add as a New Plan to save the original plan and add the new plan to the database. On all subsequent appearances of the message, select Change Plan for All to save the current changes to the new plan.

4. To implement the capitation plan, do the following:

· Capitation Patients Per Visit – On all visits, you can treatment plan and post procedures normally. After posting the day’s procedures for the a patient, the estimated patient portion in Accounts reflects the total co-payments for the current day. The insurance portion is the amount to adjust off the account. Enter the adjustment, making sure to use the correct capitation adjustment type.

· Create a claim for the procedures and enter a zero payment on the claim. The claim will not require printing.

· Monthly Operations/Management Analysis – If the insurance carrier requires a utilization report for submission, you can print this list at any time for a given date range.

· Optional – You can create a capitation plan “family” to record monthly payments from each plan to show on the receipts reports. You can add a new payment type from the Practice Definitions dialog box for this entry. Easy Dental writes the amounts off so that the balances of the capitation families are always zero. You need to add a new adjustment type for this task. You may also want to assign these families a special billing type.