In Dentrix, insurance estimates are based on different factors. The first factor is the actual fee Dentrix posts for the procedure, which is based on the fee schedule you assign to the patient. The second factor is the way you set up the coverage table. The third factor is whether there is any information entered in the payment table. The final factor is whether patients have met any of their deductibles and/or their maximum in their insurance benefits. This topic discusses each of these factors individually and then illustrates how Dentrix calculates insurance estimates.

A fee schedule allows you to enter the dollar amount a patient is charged for a specific procedure. You can attach a fee schedule to patients in three ways:

· Through their Family File

· Through the insurance they are attached to

· Through their primary provider

Dentrix first checks the patient’s family file for a fee schedule. If a fee schedule is not attached, Dentrix checks the insurance plan. If the insurance plan does not have a fee schedule attached to it, Dentrix uses the fee schedule attached to the patient’s primary provider.

Important: Because the provider is at the bottom of the fee schedule hierarchy, you must attach a fee schedule to the provider in the Provider Information dialog box.

The coverage table allows you to enter how much an insurance plan pays for a particular procedure or group of procedures. You can also modify any coverage table entries relevant to the insurance plan. You set up coverage tables in the Family File.

You can use the payment table to enter the dollar amount the insurance plan pays for specific procedures. As payments come back from the insurance, you may choose to update the insurance coverage. The actual payment information is stored in the payment table. Therefore, you can add procedures to the payment table manually, or you can have the procedures added automatically when you post a payment to a claim.

Many times patients come to your practice after using some or all of their insurance benefits. To calculate insurance estimates properly, you must enter this information into the patient’s account.

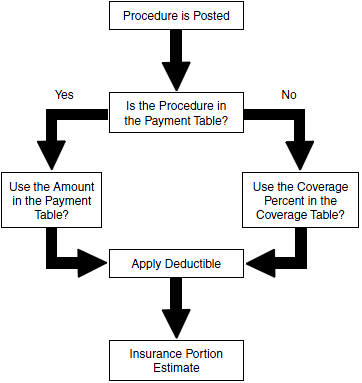

The flow chart demonstrates the steps taken when a procedure is posted to determine the estimated insurance portion:

When a deductible is applied to a procedure, two formulas are used to calculate the insurance portion:

· If the procedure is not in the payment table, the following formula is used: Insurance Portion = (Procedure Fee - Deductible) x Coverage Percent.

· If the procedure is in the payment table, the following formula is used: Insurance Portion = Payment Table Amount - (Deductible x Coverage Table Percent).

Important: To determine the patient portion, subtract the insurance portion from the procedure fee.

For example, if the patient is going to have an amalgam done for $250 with a $50 deductible and the insurance covers 80%, the insurance portion can be determined using the first formula. The insurance portion is:

· Insurance Portion = ($250 - $50) x 80% = $160

However, if the patient is going to have an amalgam done for $250 with a $50 deductible and the insurance covers 80%, but the payment table shows the insurance usually pays $180 for the procedure, the insurance portion can be determined using the second formula. The insurance portion is:

· Insurance Portion = $180 - ($50 x 80%) = $140