Using the Ledger you can set up multiple tax and discount types that you can apply to individual patients or family accounts. You can determine the amount of the tax or discount according to the current day’s charges or a specified procedure date.

Before you can apply the tax or discount, you must create tax and discount types. From the Ledger, you must assign each tax type to a procedure code or adjustment type and each discount type to an adjustment type.

Note: You should assign discounts to a credit adjustment type in order for the account balance to be decreased by the appropriate amount.

To create a tax and discount type

1. In the Ledger, click File, and then click Tax/Discount Options Setup.

The Tax/Discount Options dialog box appears.

2. Do one of the following:

· To set up a new tax/discount type, click New.

· Select an existing tax/discount type, and then click Edit to edit that type.

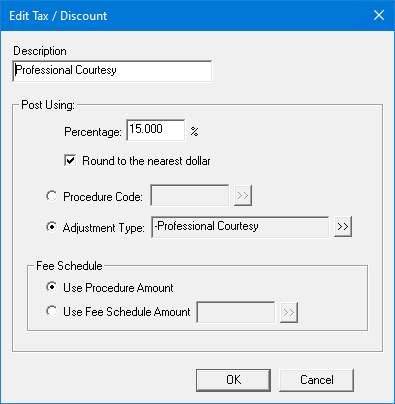

The New Tax/Discount (or Edit Tax/Discount) dialog box appears.

3. Do the following:

· Description - Type a brief description of the new tax/discount option.

· Percentage - Type the percentage that you want to apply for the tax/discount.

· Round to the nearest dollar - Select to round the tax/discount amount to the nearest dollar.

4. Select one of the following:

· Procedure Code - Adds a tax option using a procedure code.

· Click the search button, and in the Procedure Codes dialog box, select the category and the procedure code that the tax applies to.

· Click OK.

· Adjustment Type - Adds a tax option using a debit adjustment type.

· Click the search button, and in the Select Adjustment Type dialog box, select the adjustment type that you want to assign to the tax.

· Click OK.

5. Under Fee Schedule, select one of the following:

· Use Procedure Amount - Bases the tax or discount on the amount posted to the Ledger.

· Use Fee Schedule Amount - Bases the tax or discount on the amount of the procedure as listed in the fee schedule.

· To select a fee schedule, click the search button.

The Select Fee Schedule dialog box appears.

· Select a fee schedule from the list and click OK.

6. To save the new tax/discount type, click OK, and then click Close.

Note: To enter new procedure codes and/or adjustment types, click Procedure code setup.